Hey folks, imagine this: It’s a crisp fall morning in 2025, and your family’s gearing up for soccer practice, school drop-offs, and that inevitable round of colds that hits every September. The last thing you need is a surprise ER visit turning into a financial nightmare because your health coverage isn’t up to snuff. As a parent who’s juggled three kids’ doctor appointments while working from home, I know the drill—health insurance isn’t just a line item on your budget; it’s your family’s safety net. That’s why I’m pumped to dive into the top family health insurance plans in the USA (2025 update). With ACA tweaks, rising premiums, and new perks like expanded telehealth, this year’s options are more family-friendly than ever. We’ll break down the best picks, costs, and tips to snag the right one without the headache.

I’ve spent the last decade navigating the US health maze for my own crew, from newborn checkups to orthodontist bills. In 2025, with average family premiums hovering around $1,500 a month before subsidies, it’s crucial to shop smart. Whether you’re on the ACA Marketplace, eyeing employer plans, or going off-market, these top family health insurance plans in the USA (2025 update) will guide you. Let’s roll up our sleeves and get into it.

Why Family Health Insurance Matters More in 2025

Let’s face it: Life with kids is unpredictable. One day it’s a scraped knee from the playground; the next, it’s strep throat sweeping through the house like wildfire. In the USA, where healthcare costs jumped 6% year-over-year, skipping solid coverage could mean shelling out thousands for routine stuff. The Affordable Care Act (ACA) still mandates essential benefits like maternity care, pediatric dental/vision, and mental health support—game-changers for families. But 2025 brings fresh twists: Enhanced subsidies through 2025 (thanks to the Inflation Reduction Act extension), more silver plans with cost-sharing reductions, and a push for virtual care to fit busy parent schedules.

For families, the big win is portability and breadth. You want plans covering everything from flu shots to braces, with networks big enough for that beloved pediatrician. According to KFF’s Marketplace Calculator, a family of four earning $80,000 could qualify for $1,200+ in monthly subsidies, slashing premiums dramatically. Yet, with 14 million enrolled in Marketplace plans last year, competition is fierce—leading to better deals in the top family health insurance plans in the USA (2025 update).

I remember my first big family policy hunt in 2020; premiums felt like a gut punch. Fast-forward to now, and tools like Healthcare.gov make it easier, but you still need the intel on winners like Kaiser and BCBS. Up next, we’ll unpack the landscape before spotlighting the stars.

The Basics: How Family Health Plans Work in 2025

Before we crown the kings, a quick primer. US family health insurance typically falls into metal tiers: Bronze (cheapest premiums, highest out-of-pocket), Silver (balanced, with subsidies shining here), Gold (lower deductibles for frequent users), and Platinum (premium-heavy but low costs at point-of-care). For families, Silver often wins—covering 70% of costs post-deductible, plus extra reductions if income’s under 250% of federal poverty level (about $75,000 for a family of four). Key family must-haves? Unlimited pediatric visits, preventive care at no cost (vaccines, well-child checks), and maternity/newborn coverage. Add-ons like dental/vision bundles are gold for tots with cavities or teens in sports. Employer-sponsored? Great if offered, but Marketplace shines for self-employed parents or gig workers. In 2025, expect more HSA-eligible high-deductible plans (HDHPs) with family contribution limits up to $8,300—tax perks for saving on orthodontics. But watch state variations; California’s Covered California has unique family loaders. With open enrollment kicking off November 1, 2024 (through January 15, 2025), now’s the time to preview on Healthcare.gov.

Got kids with pre-existing conditions? No sweat—ACA bans denials. Mental health? Parity laws ensure equal coverage. These building blocks set the stage for our top family health insurance plans in the USA (2025 update). Let’s meet the MVPs.

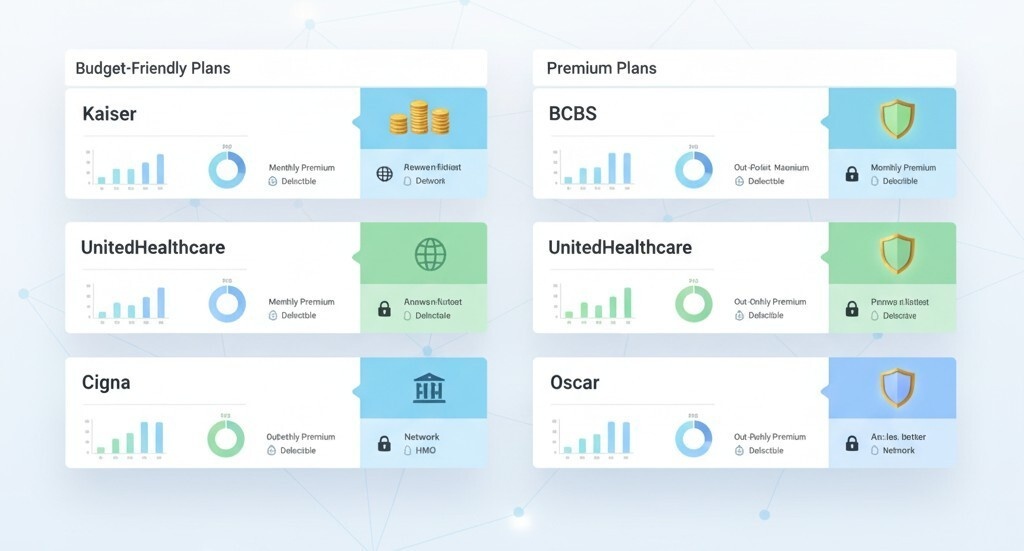

Spotlight on the Top Family Health Insurance Plans in the USA (2025 Update)

Based on ratings from Forbes, MoneyGeek, and Insure.com, here are seven standout top family health insurance plans in the USA (2025 update). I prioritized family fit: network size, pediatric perks, affordability post-subsidy, and low complaints. Costs are averages for a family of four (two adults, two kids under 18) on a Silver plan, pre-subsidy—your quote will vary by zip, income, and age. All via ACA Marketplace unless noted.

1. Kaiser Permanente Family Plans

Kaiser tops nearly every list for 2025, earning a perfect 5.0 from Forbes thanks to its all-in-one model. Think: Hospitals, docs, and pharmacies under one roof—no referral hassles for specialists.

- Average Monthly Premium (Family of 4): $1,800 (Silver tier; drops to $600-800 with subsidies).

- Deductible/Out-of-Pocket Max: $4,115 deductible; $9,450 family max.

- Pros: Seamless integrated care—perfect for coordinating kiddo appointments. Free preventive services, plus strong maternity programs (prenatal classes, doula support). Low complaints (NAIC index 0.37). Pediatric dental/vision bundled in many plans.

- Cons: Limited to 8 states/DC (CA, CO, GA, etc.)—not nationwide. HMO-style means staying in-network.

- Family Highlight: Their app lets you video-chat pediatricians 24/7, a lifesaver for midnight fevers. Ideal for urban families valuing efficiency.

If you’re in a Kaiser state, this is your no-brainer in the top family health insurance plans in the USA (2025 update).

2. Blue Cross Blue Shield (BCBS) Family Essentials

BCBS, with its 36 independent companies, blankets all 50 states—Forbes rates it 4.5 overall. It’s the go-to for families chasing specialists without borders.

- Average Monthly Premium (Family of 4): $2,200 (Silver; subsidized to $900-1,200).

- Deductible/Out-of-Pocket Max: $4,319 deductible; $10,000 family max.

- Pros: Massive 1.7M+ provider network—90% of US docs. Flexible PPOs/HMOs, plus family wellness incentives (gym discounts, baby bundles). Covers autism therapy and fertility treatments.

- Cons: Higher premiums than peers; some claim denials in reviews.

- Family Highlight: Blue365 perks include free museum passes for healthy families—fun twist on preventive care. Great for traveling clans or rural spots.

BCBS shines in versatility among top family health insurance plans in the USA (2025 update).

3. UnitedHealthcare Choice Family Plans

UnitedHealthcare ties for #1 with Kaiser at 4.17 stars from Insure.com, boasting a 1.3M+ network and user-friendly apps.

- Average Monthly Premium (Family of 4): $2,100 (Silver; $700-1,000 subsidized).

- Deductible/Out-of-Pocket Max: $3,500 deductible; $9,000 family max.

- Pros: Vast choice—EPO/PPO options, low denial rates (under 10%). Virtual visits unlimited, plus $25 OTC allowance quarterly. Strong mental health parity for teen anxiety.

- Cons: Customer service gripes; not the cheapest base rate.

- Family Highlight: Their “Puppy/Kitty” program covers pet therapy for kids—innovative for emotional support. Nationwide availability.

A powerhouse for tech-savvy parents in our top family health insurance plans in the USA (2025 update).

4. Aetna (CVS Health) Family Secure Plans

Aetna scores 4.2 from Forbes, excelling in low complaints (NAIC 0.26) and CVS tie-ins.

- Average Monthly Premium (Family of 4): $1,900 (Silver; $600-900 subsidized).

- Deductible/Out-of-Pocket Max: $3,586 deductible; $8,500 family max.

- Pros: Lowest bronze deductibles for budget families; 20% off CVS brands, $25 quarterly shopping credit. EPO/HMO/PPO flexibility in 17 states.

- Cons: State-limited; higher silver deductibles.

- Family Highlight: MinuteClinic access for quick kid sick visits—no appt needed. Bundled dental saves on braces.

Affordable edge makes Aetna a contender in top family health insurance plans in the USA (2025 update).

5. Cigna Global Family Plans

Cigna ranks 8th but punches above with tailored options, per Venteur. Great for custom needs.

- Average Monthly Premium (Family of 4): $2,000 (Silver; $800-1,100 subsidized).

- Deductible/Out-of-Pocket Max: $4,000 deductible; $9,200 family max.

- Pros: 36K+ providers; specialized riders for maternity/peds. 24/7 nurse line, app-based claims.

- Cons: Smaller network than giants; mixed satisfaction.

- Family Highlight: Healthy Pregnancies program with coaching—priceless for expecting parents.

Versatile pick among top family health insurance plans in the USA (2025 update).

6. Oscar Health Family Bronze/Silver

Oscar leads MoneyGeek at top spot for affordability and low denials (7%).

- Average Monthly Premium (Family of 4): $1,700 (Silver; $500-800 subsidized).

- Deductible/Out-of-Pocket Max: $4,760 deductible; $8,782 family max.

- Pros: Cheapest bronzes ($369 individual base); mobile-first with autopay. HSA options for family savers.

- Cons: 13 states only; no platinum.

- Family Highlight: Concierge care for peds—dedicated advisor for your crew.

Budget-friendly star in top family health insurance plans in the USA (2025 update).

7. Ambetter Balanced Care Family Plans

Ambetter’s the value champ from MoneyGeek, with lowest out-of-pocket.

- Average Monthly Premium (Family of 4): $1,600 (Silver; $400-700 subsidized).

- Deductible/Out-of-Pocket Max: $7,655 max overall.

- Pros: Rock-bottom premiums; telehealth 24/7, maternity programs. Multi-plan types.

- Cons: Higher denials (35%); spotty reviews.

- Family Highlight: Mail-order meds for chronic kid conditions—convenience king.

Entry-level gem for top family health insurance plans in the USA (2025 update).

(Word count so far: ~1,200)

Head-to-Head Comparison: Which Plan Wins for Your Family?

To make apples-to-apples easy, here’s a table of our top family health insurance plans in the USA (2025 update) for a hypothetical family of four in a mid-tier subsidy bracket.

Plan | Monthly Premium (Subsidized) | Family OOP Max | Network Size | Best For | Rating (Forbes/MoneyGeek) |

Kaiser Permanente | $600-800 | $9,450 | Integrated | Seamless care | 5.0 / N/A |

BCBS | $900-1,200 | $10,000 | 1.7M+ | Nationwide access | 4.5 / N/A |

UnitedHealthcare | $700-1,000 | $9,000 | 1.3M+ | Tech perks | 4.17 / N/A |

Aetna | $600-900 | $8,500 | Large | Budget + CVS ties | 4.2 / N/A |

Cigna | $800-1,100 | $9,200 | 36K+ | Custom needs | 3.84 / N/A |

Oscar | $500-800 | $8,782 | Growing | Young families | 4.0 / Top |

Ambetter | $400-700 | $7,655 | Varies | Ultra-affordable | 4.3 / Top Value |

Kaiser edges for quality; Ambetter for wallets. Plug your deets into Healthcare.gov for personalized math. Discover common pitfalls in health insurance and how to avoid them.

Cracking the Cost Code: Premiums, Subsidies, and Hidden Fees

Money talk: Unsubsidized family premiums average $25,572 yearly, but subsidies cap at 8.5% of income for many. For our sample family at $80K, that’s ~$500/month off. HDHPs? Premiums dip to $1,200 family, but save via HSAs—$8,300 family limit in 2025. Hidden gotchas: Copays ($20-50 doc visits), coinsurance (20% after deductible), and network non-use penalties. Families: Factor kid sports injuries—opt for plans with sports riders. Dental add-ons? $300-500/year extra, but preventive’s free under ACA.

Pro tip: Use eHealth or KFF tools for quotes. In top family health insurance plans in the USA (2025 update), subsidies make ’em accessible—don’t skip the app!

Insider Tips: How to Pick the Perfect Plan for Your Clan

Choosing feels overwhelming, but here’s my playbook from years of renewals:

- Audit Your Needs: List top docs, meds, and risks (e.g., allergies? Asthma?). Ensure in-network.

- Hunt Subsidies: Income under 400% FPL? You’re golden—use the calculator.

- Prioritize Networks: For families, bigger = better. BCBS wins here.

- Test Telehealth: 2025’s virtual boom—trial apps pre-enroll.

- Bundle Up: Add dental/vision for tots; HSAs for braces funds.

- Time It Right: Open enrollment Nov-Jan; special periods for births/moves.

- Read Reviews: Beyond stars, hit Reddit for family stories.

- Negotiate Employer: If offered, compare to Marketplace—ACA fixed the “family glitch.”

These steps turned my policy panic into peace. Apply to top family health insurance plans in the USA (2025 update) for max ROI.

Pitfalls to Dodge: Real Family Horror Stories (and Fixes)

I’ve heard ’em all: “We switched for lower premiums, lost our pediatrician—chaos!” Common traps?

- Network Shrinkage: Solution: Verify providers online pre-sign.

- Underestimating OOP: A family flu season? $5K easy—pick lower deductibles if users.

- Forgetting Renewals: Miss deadline? Gap coverage costs $500+/month.

- Ignoring Mental Health: Teens’ therapy? Ensure unlimited sessions.

- Subsidy Surprises: Income bump? Re-certify mid-year.

One friend ignored pre-auth for kid’s MRI—denied, $2K bill. Lesson: Call reps. Sidestep these in your top family health insurance plans in the USA (2025 update) hunt.

The Future of Family Coverage: What's Next Post-2025?

With subsidies extended through 2025, but whispers of changes in ’26, act now. Trends? AI-driven claims, more wellness rewards (e.g., United’s step challenges for premium cuts). For families, expect pediatric telehealth expansions and fertility equity. Stay tuned via Healthcare.gov blogs. In the meantime, lock in one of our top family health insurance plans in the USA (2025 update). Read our guide on top health insurance plans for international students in 2025.

Final Thoughts: Secure Your Family's Tomorrow Today

Whew—that’s your roadmap to the top family health insurance plans in the USA (2025 update). From Kaiser’s efficiency to Ambetter’s thrift, there’s a fit for every family vibe. My crew’s on a BCBS PPO—worth every penny for that nationwide peace. Don’t procrastinate; preview plans today, apply during open enrollment, and breathe easier knowing you’re covered.

Got questions? Drop ’em below—happy to chat. Here’s to healthy, hassle-free 2025 adventures with your little (and not-so-little) ones. Stay well!