Introduction

Money is something we all think about every single day. When you have a high income, saving feels easier. But when the income is low, saving money feels like climbing a mountain. I know this because I, Ritesh, have been writing in the finance sector for over two years and I have seen how tough money management becomes when income is limited.

Still, saving money is not impossible. Even if your income is small, you can save smartly if you follow the right steps. In this guide, I will share with you how to save money fast on a low income using very simple methods. My aim is to keep everything practical, easy to follow, and written in simple English so that anyone can understand.

Let’s start with the basics.

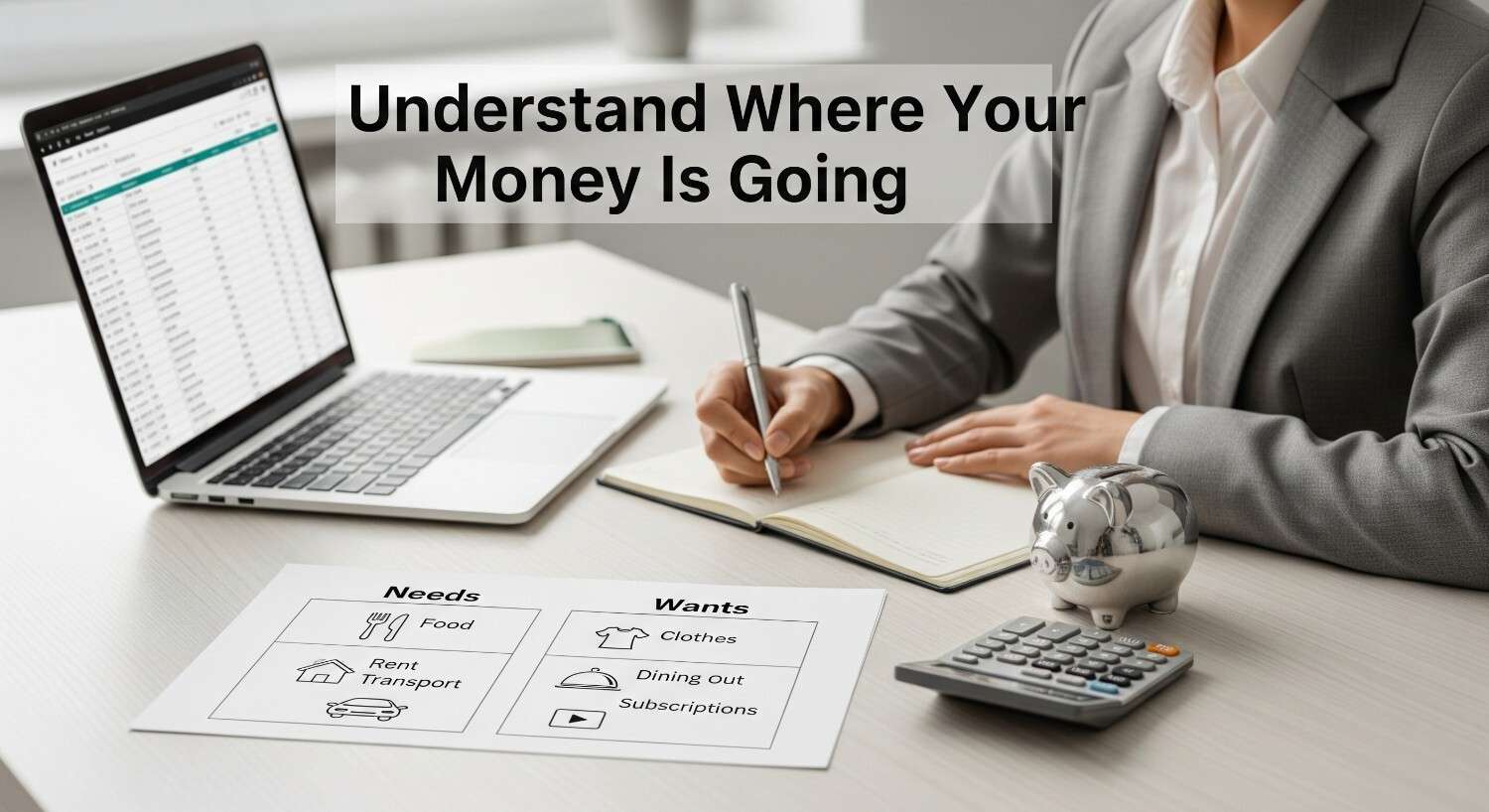

Understand Where Your Money Is Going

Before saving, you need to know where your money is disappearing every month. Many people feel they don’t earn enough, but in reality, the issue is not always income. The problem is that money is spent on things that don’t matter much.

Here’s what you can do:

- Write down your expenses for one month.

- Divide them into two groups: “Needs” and “Wants.”

- Needs are things like rent, food, transport. Wants are things like dining out, new clothes, subscriptions.

Once you see this list, you will clearly understand where your money is going. Most people are shocked when they see how much they spend on wants. That’s the first step to saving.

Make a Simple Budget That Actually Works

The word “budget” sounds boring, but it is your best friend when your income is low. Without a budget, your money controls you. With a budget, you control your money.

A simple way to start is:

- First, list down your total income.

- Next, write all fixed costs (rent, bills, travel).

- Then set aside at least a small percentage for savings. Even if it’s just 5%, keep it.

- The remaining money is what you can spend on wants.

It doesn’t have to be perfect. The goal is just to give every rupee or dollar a purpose so that it doesn’t disappear without you knowing.

Cut Down on Small Daily Expenses

Sometimes we think saving means cutting big expenses. But the truth is, small daily expenses hurt more in the long run. Buying snacks every day, ordering food online, or using cabs for short trips looks small, but it adds up.

Try these changes:

- Cook at home instead of ordering every day.

- Use public transport when possible.

- Carry your own water bottle and snacks.

These are tiny adjustments, but they create huge savings over months. And the best part is you don’t even feel like you are sacrificing much.

Avoid Impulse Buying

Let’s be honest. We have all done it. You see a discount online, you click “buy,” and later you regret it. That is impulse buying. When your income is low, impulse buying is your biggest enemy.

Here’s how you can stop it:

- Before buying anything, wait for 24 hours. If after one day you still feel you need it, then buy.

- Ask yourself: “Do I need this, or do I just want it?”

- Unsubscribe from sales emails and remove shopping apps if they tempt you too much.

Controlling impulse buying alone can save you thousands over a year.

Find Cheaper Alternatives for Everyday Living

One of the smartest ways to save money is by finding cheaper options for the same things. When income is low, every small saving matters.

Think about your monthly expenses:

- Switch to a cheaper internet or mobile plan.

- If you drink tea or coffee outside daily, start making it at home.

- Buy groceries from wholesale shops instead of expensive supermarkets.

The idea is simple: don’t stop living your life, just live it in a more affordable way.

Learn to Say No

Saving money is not just about numbers, it’s also about discipline. Many times, friends may invite you out, or you may feel pressure to buy something just because others are buying. This is where you have to learn to say no.

It might feel difficult at first, but remember, your financial future is more important than temporary enjoyment. Saying no today means saying yes to a better tomorrow.

Build an Emergency Fund

If you are living on a low income, one sudden medical bill or job loss can break your savings completely. That is why you need an emergency fund.

You don’t have to save thousands immediately. Start small. Even saving 500 or 1000 every month can slowly grow into a safety net. Over time, aim to save at least 3 to 6 months of expenses.

This fund gives you peace of mind and protects you from unexpected situations.

Save First, Spend Later

Most people spend first and then try to save whatever is left. But usually, nothing is left. Instead, reverse the system. The moment you get your income, save a fixed portion. Even if it’s only 5% or 10%, put it aside first.

This simple habit builds discipline and ensures that you save something every single month, no matter how low your income is.

Avoid Debt as Much as Possible

Debt looks easy at first. Credit cards, personal loans, buy-now-pay-later schemes… all of these feel helpful when money is short. But debt takes away your future income.

If you are already in debt, try to pay it off slowly. Stop adding new debt. Focus on cash purchases instead of credit. Living debt-free is one of the fastest ways to truly save money on a low income.

Use Cash Instead of Digital Payments

Digital payments are easy but they make you spend without thinking. When you pay by cash, you actually feel the money leaving your hand, and that makes you more careful.

If you struggle to control spending, try using cash for daily expenses. Set aside a weekly cash budget and once it’s gone, it’s gone. This method keeps spending in control.

Take Advantage of Free Resources

Not everything in life needs money. Many things are available for free if you know where to look.

- Use free entertainment like YouTube instead of costly subscriptions.

- Learn skills from free online courses instead of paid ones.

- Join local libraries instead of buying books.

The world is full of free or cheap options. All you need is the habit of searching for them before spending.

Increase Your Income Slowly

Yes, the focus here is saving money, but let’s be honest: income plays a big role. If you only rely on saving, your progress will be slow. If you also try to increase your income, even a little, you will save faster.

Some ideas you can try:

- Do freelance work online.

- Start a small side hustle like selling items online.

- Teach or tutor in your free time.

Even a small extra income of a few hundred or thousand every month makes a big difference when combined with savings.

Track Your Progress

Saving money is like losing weight. If you don’t track it, you lose motivation. Keep a notebook or use a free app to record how much you save each month.

When you see your savings grow, even slowly, it gives you confidence and keeps you motivated to continue.

Stay Patient and Consistent

Saving money fast on a low income is not about shortcuts. It is about habits. When you cut expenses, avoid debt, save first, and control impulse buying, your money automatically grows.

At first, progress may look small. But with consistency, the results are powerful. Remember, small savings today become big savings tomorrow.

Final Thoughts

I have been writing in the finance sector for more than two years, and one thing I have learned is this: saving is less about how much you earn and more about how you manage what you earn.

Even on a low income, you can save money fast if you make small changes in your lifestyle, stay disciplined, and keep reminding yourself of your future goals. It’s not about perfection, it’s about consistency.

Start today. Track every expense, save before spending, avoid impulse buys, and look for cheaper alternatives. Within a few months, you will see a clear difference in your savings.

And remember, it’s your journey. Be proud of every single rupee or dollar you save. It all counts.

👉 If you also want to explore simple ways to boost your income alongside saving, check out my guide on Best Side Hustles 2025 for Beginners. It can help you move faster toward your financial goals.