Hey there! So, you’re a student. Your life is probably a crazy mix of classes, assignments, friends, and trying to figure out what you want to do with your life. And in the middle of all this, there’s this constant worry: “Pata nahi paise kahan chale jaate hain!” (I don’t know where the money goes!). When you are a student, money feels like sand slipping through your fingers. A little pocket money or part-time income comes in, and before you know it, it’s gone on food, travel, or hanging out with friends. I’ve been through that phase too, and trust me, figuring out how to manage finances as a student can feel impossible at first. But once you get the basics right, it actually becomes simple.

This blog is not going to throw heavy financial jargon at you. I’m going to share tips and lessons that I wish someone had told me when I was in college. These are practical, real-life things you can start doing today, without feeling like you’re sacrificing all the fun of student life.

Wait, Why Should I Even Bother?

I get it. Thinking about money right now feels like an extra burden. You’ve got enough on your plate! But trust me, learning to manage finances as a student is one of the smartest things you can do. Here’s why:

- Goodbye Tension! Money problems are a huge source of stress. When you have a plan, you have peace of mind. You can actually enjoy your time in college instead of constantly worrying about cash.

- It’s a Superpower for Life: The habits you build now will stay with you forever. Imagine being that super-organized adult who always has their money sorted. It all starts here!

- You’ll Be Ready for Anything: Your phone might break, you might need to take a sudden trip home—life is full of surprises. When you have some savings, these surprises become small problems, not big disasters.

- You’ll Value Money More: When you see where each rupee goes, you start understanding its real value. You’ll think twice before spending on things you don’t really need.

So, yeah, it’s a big deal. It’s the first step towards being independent and smart about your life.

Step 1: Let’s Play Detective – Where Is Your Money Going?

You can’t control something you don’t understand. So, the first step to manage finances as a student is to become a detective of your own spending. For one month, I want you to track every single rupee you spend.

Seriously. Every. Single. Rupee.

That packet of chips? Write it down. That auto-rickshaw fare? Write it down. That recharge for your phone? Write it down.

How to do it?

- Old School: Keep a small notebook and pen in your pocket. It works like a charm.

- New School: Use the notes app on your phone. Or, use a free money management app like Wallet or Money Manager. They make it really easy.

At the end of the month, you will have a list. This list will probably shock you. You’ll see, “Arre, maine itna paisa chai-peeke udaya?!” (Oh, I spent so much money on tea!). That’s the whole point. This list is your secret weapon to make a plan.

Step 2: Make a Simple Plan (The Budget – It’s Not a Bad Word!)

Now that you know where your money goes, it’s time to tell it where to go. This is called a budget. And it’s not a prison for your money; it’s a plan that gives you freedom.

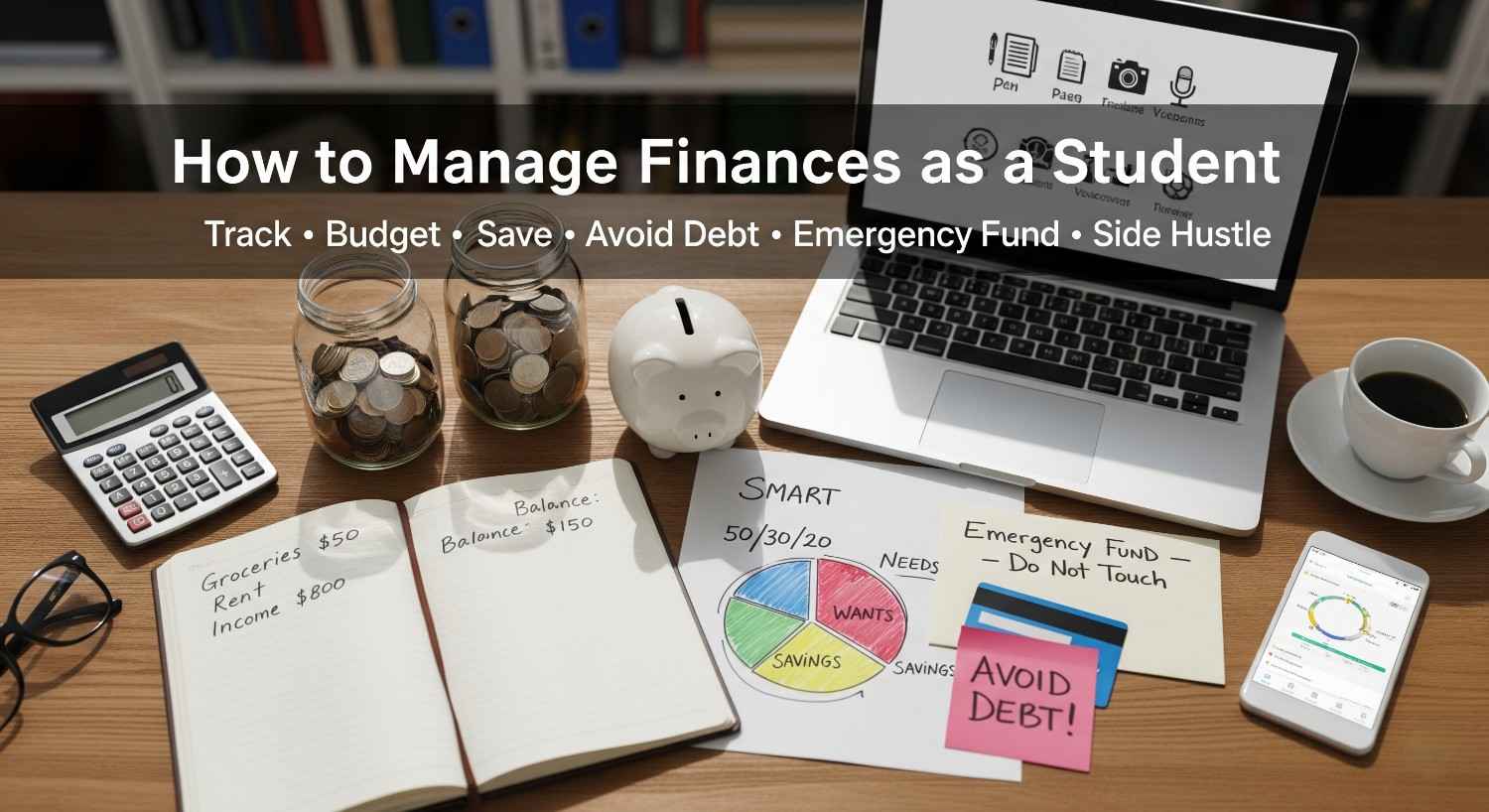

A super easy method for students is the 50/30/20 Rule. Here’s how it works:

- 50% for Your Needs: This is for stuff you absolutely must pay for. Like rent, groceries, college fees, bus pass, and basic bills. These are your non-negotiables.

- 30% for Your Wants: This is the fun part! This money is for movies, eating out, new clothes (that you don’t need), hobbies, and hanging out with friends.

- 20% for Your Future Self: This is the most important part. This money goes straight into your savings. Think of it as paying your future self first.

Let’s take an example. Suppose you get Rs. 10,000 a month.

- Needs: Rs. 5,000 for rent, food, and bills.

- Wants: Rs. 3,000 for fun.

- Savings: Rs. 2,000 goes directly into a savings account. Do not touch this!

See? It’s simple math. The goal is to fit your spending into these boxes.

Step 3: How to Actually Save Money (Without Becoming a Miser)

Saving money doesn’t mean you stop having fun. It just means you become smarter about it. Here are some real tips that work:

- The Magic of ‘Pay Yourself First’: The moment you get your money (from home or a job), take that 20% and put it away in a separate savings account. Then live on the remaining 80%. If you wait to see what’s left at the end of the month, there will be nothing left.

- Your Student ID is a Goldmine: Never, ever leave your home without it! So many places offer student discounts—movie theaters, museums, software companies (like Microsoft and Adobe), and even some cafes and shops. Just flash that ID and ask, “Do you have a student discount?”

- Food is the Biggest Trickster: We spend a lot on food without realizing.

- Try to eat in the college canteen or mess. It’s cheaper.

- Cooking with friends can be fun and saves a ton of money compared to ordering from Swiggy or Zomato.

- Carry a water bottle from home. Buying bottled water every day adds up.

- The 24-Hour Cool-Down: Before you buy anything that’s not a essential, wait for 24 hours. Often, you’ll find that the urge to buy it passes. This saves you from impulse buys.

- Second-Hand is Super Cool: Don’t be shy to buy second-hand books, furniture, or even electronics. Your seniors are always selling stuff as they pass out. You can get great things for almost half the price!

Using these simple tricks is how you can easily manage finances as a student without feeling like you’re missing out.

Step 4: The Biggest Danger – Debt! (Please Be Careful)

This is a very important chapter. As a student, you might get offers for credit cards or ‘Buy Now, Pay Later’ schemes like Simpl or Lazypay.

They make it seem so easy, right? Just swipe now, worry later.

Here’s the truth: They are dangerous if you don’t know how to use them.

This is a crucial part of learning how to manage finances as a student. If you use a credit card, follow this one rule: Only spend the money you already have in your bank account.

This means if you have Rs. 5,000 in your account, your credit card bill should never be more than Rs. 5,000. And when the bill comes, pay the FULL amount immediately. Do not just pay the “minimum amount due.” If you only pay the minimum, the bank charges you a huge amount of interest, and you can quickly get trapped in debt.

It’s better to avoid them until you are confident. Your goal is to build a good financial future, not dig a hole of debt early on.

Step 5: Your Financial Superman – The Emergency Fund

An emergency fund is not an investment. It’s your safety net. It’s money you keep aside for… well, emergencies!

What is an emergency?

- Your laptop suddenly dies before your exams.

- You have a medical emergency.

- You need to travel home unexpectedly.

This is why you need an emergency fund. So you don’t have to ask your parents for help or use a high-interest credit card in a panic.

How to build it?

Start small. Aim for Rs. 2,000. Then Rs. 5,000. Your ultimate goal should be to save enough to cover 2-3 months of your essential expenses. Keep this money in a separate savings account where you won’t be tempted to touch it for everyday spending. This single step will make you feel so much more secure and grown-up.

Step 6: Want More Money? Let’s Talk Side Hustles!

Sometimes, cutting costs can only go so far. The other side of the coin is to make more money! The good news is, there are so many ways a student can earn a little extra cash.

Here are some ideas:

- Use Your Skills: Are you good at a subject? Offer tuition to younger students. Good at writing or design? Check out websites like Fiverr or Upwork for small freelance projects.

- On-Campus Jobs: Many colleges have jobs in the library, computer lab, or canteen. They understand your schedule and are usually flexible.

- Part-Time Work: You can work at a retail store, a cafe, or a delivery service on weekends.

- Be Creative: Love photography? Click pictures at events. Good at crafts? Sell your creations online.

A side hustle not only gives you extra money but also gives you real-world experience. It’s a win-win!

💡 “If you found these student money management tips useful, you should also check out my other blog — Best Side Hustles 2025 for Beginners. It shares simple ways students can earn extra income in their free time and make their financial journey stronger.”

Why Money Management Matters in Student Life

Most students think, “I’ll start worrying about money when I get a job.” That’s the biggest mistake. The habits you form now will follow you for years. If you don’t know how to manage finances as a student, chances are you’ll carry bad spending habits into adulthood too. I’ve seen students borrowing money from friends just to party, swiping credit cards for clothes they didn’t need, or ending up broke by the middle of the month. On the other hand, I’ve also seen students who had control over their money, saved a little every month, and graduated with confidence instead of debt. Which one do you want to be?

Start with a Simple Budget

Forget those complicated Excel sheets you see on finance blogs. When I was in college, my budget was a simple notebook. At the start of the month, I would write down my income – pocket money, scholarship, or salary from my side hustle. Below that, I listed my regular expenses: hostel fee, mess charges, bus pass, and a rough estimate for food and entertainment. Tracking this way opened my eyes. I realized I was spending more on outside snacks than on books. That’s when I understood the power of budgeting. You don’t need fancy tools – even a diary works. If you’re into apps, great, but the point is: know where your money is going.

Needs vs. Wants – The Student Dilemma

Here’s the thing. Every student has wants, and there’s nothing wrong with that. You may want the latest sneakers, a new phone, or to try every café in town. But your needs are different: rent, meals, transport, internet, and study material. One trick I used was to ask myself before every purchase: Will this still matter to me in a week? If the answer was no, I skipped it. Most of the time, that saved me money on impulse buys. Learning this simple difference is at the heart of how to manage finances as a student.

Food – The Silent Budget Killer

If you are a student living away from home, you know how tempting it is to eat out. But the truth? It eats your wallet faster than your stomach. During my first year, I spent more money on pizzas and burgers than on actual groceries.

Then one day, I calculated: one pizza = three home-cooked meals. That changed everything. I started cooking simple food with my roommates. Not only was it cheaper, it was healthier too. I’m not saying never eat out – just balance it. Maybe keep weekends for cafés and weekdays for home food.

Entertainment Without Burning Cash

Student life is meant to be fun. But parties, subscriptions, and outings can empty your pocket in no time. What worked for me was finding free or cheap alternatives. Campus events, college fests, open-mic nights – these were free and honestly more fun than expensive clubs. If you want Netflix, share it with friends. If you love movies, have movie nights at someone’s room instead of theatres every weekend. Small choices like these make a huge difference when learning how to manage finances as a student.

The Magic of Student Discounts

This one is gold. As a student, you can get discounts on software, transport, cinemas, restaurants, even online courses. Most students don’t bother asking, but trust me, showing your ID card can save you a lot over the years. I remember once getting 50% off on a train pass just because I asked. That saved me thousands by the end of the year. So don’t be shy – always check if there’s a student discount available.

Stay Away from Debt Traps

Here’s a lesson I learned watching my friend: credit cards are dangerous if you don’t know how to handle them. He used his card to buy a new phone “on EMI.” Before he knew it, he was drowning in interest payments because he kept missing deadlines. If you’re serious about how to manage finances as a student, avoid unnecessary loans or credit cards. If you absolutely need a loan (say for education), that’s fine – but don’t borrow for lifestyle expenses. Rule of thumb: if you can’t pay for it with cash, you probably shouldn’t buy it.

Earn a Little on the Side

In today’s world, you don’t need to wait for a job to earn. I started freelance writing in my second year, and the extra money felt like magic. It helped me pay my bills and taught me real-world skills. You can tutor online, do part-time gigs, freelance design, create content, or sell digital products. Even if you earn a small amount, it reduces pressure on your parents and gives you confidence. Side hustles are a game-changer in how to manage finances as a student.

Build an Emergency Cushion

Imagine this: your laptop suddenly stops working before exams. Or you need urgent money for travel. What do you do? Most students panic and borrow. But if you have even a small emergency fund, you’re safe.

I used to save just ₹500 every month. By the end of the year, I had enough to handle any small crisis without calling home. The peace of mind it gave me was priceless. Start small – even 5% of your income – and keep it aside.

Use Apps to Track Your Money

When I first started budgeting, I used pen and paper. But later I discovered apps like Splitwise and Walnut, which made tracking super easy. These apps send alerts, show where you overspend, and help you stay on track. If you’re serious about how to manage finances as a student, try using at least one money tracking app. It’s like having a mini financial advisor in your pocket.

Start Saving and Investing Early

This may sound boring, but trust me, starting early gives you a big head start. Even if you save a small amount and put it in a simple SIP or recurring deposit, the power of compounding will surprise you later.

When I started investing, I only put ₹1000 per month in a SIP. Today, I realize how much that habit has grown. As a student, don’t worry about big amounts – focus on consistency.

Don’t Let Peer Pressure Drain Your Wallet

One of the hardest things in student life is saying “no” when your friends are spending. Whether it’s eating out every day, buying branded clothes, or going on trips, peer pressure is real. But here’s the truth: your financial situation is not the same as theirs. If you can’t afford it, be honest. Good friends will understand. The ability to resist peer pressure is a secret weapon in mastering how to manage finances as a student.

Final Thoughts

Learning how to manage finances as a student is not about becoming a miser. It’s about balance. It’s about enjoying life while also being smart with money. Trust me, you don’t want to graduate with empty pockets and bad habits.

Start small: make a budget, cook at home, save a little, use discounts, and avoid debt. Over time, you’ll notice how confident you feel with money. These habits will follow you into your job, your family life, and your future. Student years are not just about passing exams; they’re about learning life skills. And money management is one of the most valuable skills you can ever learn.