Hey there! Imagine this: You’re ready to buy your dream car, apply for a new apartment, or even launch a small business, but then—ouch—your credit score throws a wrench in the plans. A low score can mean higher interest rates, rejected applications, or even missed opportunities. I’ve been there, staring at a 600-something score after some reckless student loan days, wondering how to climb out of the hole. Fast forward to 2025, and I’ve learned the ropes, boosting my score to the high 700s. If you’re looking to take control of your financial future, this guide on how to improve credit score is your roadmap. Packed with practical, human-tested tips, we’ll cover everything from quick wins to long-term strategies, all tailored for the US system in 2025. Let’s dive in and turn that number into your financial superpower!

I’ve spent years navigating the credit maze, from disputing errors to juggling payments across continents as a freelancer. With 35% of Americans having subprime scores (below 670) in 2025, you’re not alone if you’re starting low. But the good news? You can improve your score, and it’s not as daunting as it seems. Whether you’re aiming for a mortgage or just want better credit card perks, mastering how to improve credit score is your ticket to financial freedom. Let’s break it down.+

Why Your Credit Score Matters in 2025

Your credit score—typically the FICO score (300-850)—is like a report card for your financial trustworthiness. Lenders, landlords, and even some employers use it to gauge risk. In 2025, with interest rates climbing (average mortgage rates at 6.7%) and inflation pinching wallets, a strong score (700+) can save you thousands. For example, a 750 score might snag a 5.5% mortgage rate, while a 650 could mean 7%—that’s $20,000+ extra over a 30-year loan for a $300,000 home.

A low score also limits credit card rewards, jacks up insurance premiums, and can even block rentals. I learned this the hard way when a landlord passed me over for a sub-650 score in my early 20s. The stakes are high, but the fix is within reach. Let’s unpack the FICO formula and then dive into actionable steps for how to improve credit score.

Understanding the FICO Score Breakdown

FICO, used by 90% of lenders, breaks down like this:

- Payment History (35%): Paying bills on time is king. One late payment can drop your score by 60-100 points.

- Credit Utilization (30%): How much of your available credit you’re using. Aim for under 30%.

- Length of Credit History (15%): Older accounts boost scores. Average age matters.

- Credit Mix (10%): Variety of accounts (credit cards, mortgages, auto loans) helps.

- New Credit (10%): Too many applications in a short time? Red flag.

VantageScore, another model, is similar but weighs recent behavior more. In 2025, both are accessible via free tools like Experian’s app or Credit Karma. Knowing this is step one in how to improve credit score. Now, let’s get to the good stuff—strategies that work.

Top Strategies to Improve Your Credit Score in 2025

1. Pay Bills On Time, Every Time

Late payments are the fastest way to tank your score. A single 30-day-late hit can linger for seven years! Set up autopay for at least the minimum on all accounts—credit cards, utilities, student loans. I once missed a $25 card payment by a day; my score dipped 40 points. Ouch.

Pro Tip: Use calendar alerts or apps like Mint to track due dates. If you’re late, call the creditor—some forgive one-offs if you ask nicely. Payment history is the backbone of how to improve credit score, so prioritize this.

2. Lower Your Credit Utilization Ratio

This is a game-changer. If your card has a $10,000 limit and you’re carrying a $4,000 balance, that’s 40% utilization—too high. Aim for under 30% ($3,000 in this case). Pay down balances aggressively, starting with high-interest cards. I slashed my utilization from 50% to 15% in six months, boosting my score by 80 points.

Hack: Ask for a credit limit increase without a hard inquiry—more limit, lower ratio. Just don’t spend the extra. In 2025, issuers like Chase are loosening limits for good customers. This is a cornerstone of how to improve credit score.

3. Tackle Debt Strategically

High debt kills scores via utilization and missed payments. Use the avalanche method (highest interest first) or snowball method (smallest balance first) to pay off cards. I used snowball to clear three small cards in 2023, which felt like a win and kept me motivated. Average credit card debt in 2025 is $6,800—chip away monthly.

Tool: Debt consolidation loans (rates ~7-12% for fair credit) can simplify payments. Check SoFi or LightStream. Paying off debt is a slam dunk for how to improve credit score.

4. Check and Dispute Credit Report Errors

Errors are common—28% of Americans find mistakes on reports. I found a $500 medical bill I’d paid listed as delinquent; disputing it raised my score 30 points. Get free reports weekly from AnnualCreditReport.com (Equifax, Experian, TransUnion) in 2025.

Steps: File disputes online or via certified mail. Provide proof (receipts, statements). Bureaus have 30 days to fix. This is a quick win in how to improve credit score.

5. Keep Old Accounts Open

Closing old cards shortens your credit history, dinging your score. My oldest card (10 years) adds heft to my file. Keep it active with small, paid-off charges—like a $10 Netflix bill monthly. In 2025, average credit history for a 750+ score is 7 years. Protect your history for how to improve credit score.

6. Limit New Credit Applications

Each hard inquiry can shave 5-10 points off your score, lasting a year. I applied for three cards in a month once—my score dropped 25 points. Space applications by six months. Soft inquiries (pre-qualifiers) don’t hurt, so use those on sites like NerdWallet. Be strategic in how to improve credit score.

7. Become an Authorized User

If a spouse or parent has stellar credit, ask to be added as an authorized user on their card. Their good habits (low utilization, timely payments) boost your score without you lifting a finger. My sister added me to her card in 2022; my score jumped 50 points in months. No risk if you don’t use the card. A sneaky trick for how to improve credit score.

8. Use Credit-Builder Tools

New to credit? Try tools like Experian Boost, which adds utility/phone payments to your report—free and can add 10-20 points. Secured cards (e.g., Discover It, $200 deposit) build credit fast. I started with one; six months of on-time payments got me a 650 score. Essential for beginners in how to improve credit score.

9. Diversify Credit Types

A mix of revolving (cards) and installment (loans) looks good. If you only have cards, consider a small personal loan ($1,000) and pay it off early. My auto loan added 15 points to my score over a year. Don’t overdo it—manage what you have. A balanced mix supports how to improve credit score.

10. Monitor Your Score Regularly

Knowledge is power. Use free apps like Credit Karma or Experian for weekly updates. I caught a fraudulent account in 2024 via monitoring—froze it before damage. In 2025, 60% of Americans check monthly, up from 45% in 2020. Stay vigilant for how to improve credit score.

Curious about whether a credit card or debit card is the smarter choice in 2025? Don’t miss our detailed comparison to find out which one fits your spending habits, benefits, and financial goals best. Read Here 👈

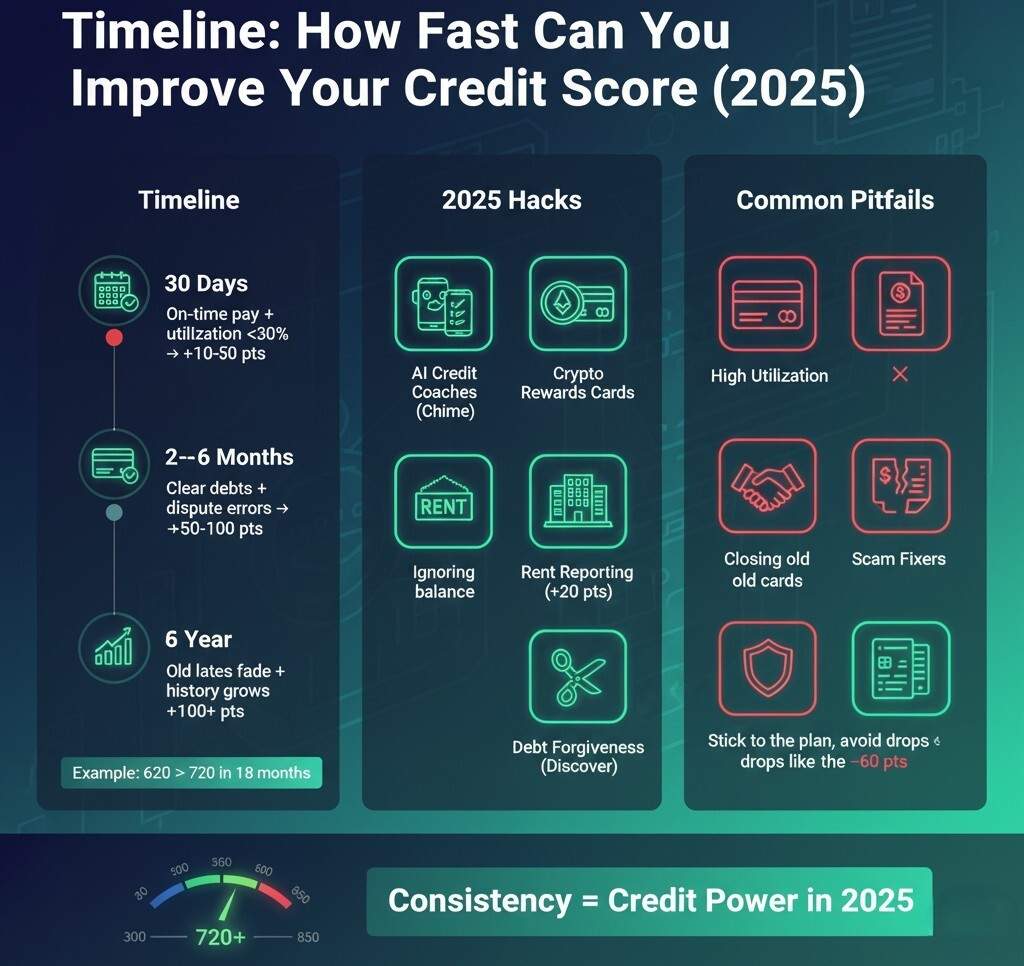

Timeline: How Fast Can You Improve Your Score?

- 30 Days: Pay on time, reduce utilization below 30%. Gain: 10-50 points.

- 3-6 Months: Clear small debts, dispute errors. Gain: 50-100 points.

- 1 Year: Old lates fade, history grows. Gain: 100+ points.

My score went from 620 to 720 in 18 months with consistent payments and utilization cuts. Patience pays in how to improve credit score.

2025-Specific Hacks: What’s New?

This year’s landscape adds fresh tools:

- AI Credit Coaches: Apps like Chime’s Credit Builder now use AI to suggest payment plans, saving users 15% on interest.

- Crypto Rewards Cards: Gemini’s card reports crypto-backed payments to bureaus, boosting scores.

- Rent Reporting: Services like StellarFi add rent to reports—$500/month rent can lift scores 20 points.

- Debt Forgiveness Trends: Some lenders (e.g., Discover) offer one-time late forgiveness in 2025.

Leverage these for how to improve credit score faster.

Common Pitfalls and How to Avoid Them

I’ve stumbled, so you don’t have to. Watch out for:

- Maxed-Out Cards: Keep utilization under 30%. Pay mid-cycle if needed.

- Ignoring Small Balances: $50 late? Still hurts. Autopay everything.

- Closing Cards Post-Payoff: Keep open for history.

- Falling for Scams: “Fix your score for $500!”—run. Use legit bureaus.

- Over-Applying: One app every 6 months, max.

A friend closed two old cards—score dropped 60 points. Stick to the plan for how to improve credit score.

Special Cases: Rebuilding After Setbacks

- Bankruptcy: Chapter 7 stays 10 years, but scores can hit 700 in 2-3 years with secured cards, timely payments.

- Collections: Pay or settle; some bureaus remove post-payment in 2025.

- Student Loans: Auto-debit cuts rates 0.25% and ensures on-time.

I settled a $1,000 collection for $600; it vanished from my report. Persistence wins in how to improve credit score.

Tools and Resources for 2025

- Free Monitoring: Credit Karma, Experian, WalletHub.

- Dispute Portals: Equifax, Experian, TransUnion online.

- Budget Apps: YNAB, Mint for payment tracking.

- Credit-Builder Loans: Self, Kikoff ($10/month, easy).

- Counseling: Nonprofits like NFCC offer free debt plans.

These are your allies in how to improve credit score. Looking for the best credit cards for students in 2025? Discover top picks that help build credit, earn rewards, and fit a student budget perfectly.Read here 👈

The Emotional Side: Staying Motivated

Credit repair isn’t just numbers—it’s mental. I felt defeated seeing 620, but small wins (paying off a $200 card) kept me going. Celebrate milestones: 650, 700, 750. Join Reddit’s r/CRedit for community tips—real stories inspire. Mindset matters in how to improve credit score.

Final Thoughts: Your Credit, Your Power

There you have it—the ultimate guide on how to improve credit score in 2025. From autopay to utilization hacks, these steps turned my financial life around, and they can for you too. Start small: Check your report today, set up one autopay, and watch your score climb. In a year, you could be unlocking better loans, sweeter cards, or that dream lease. Got a tip or story? Share below—I’m all ears. Here’s to crushing it in 2025!