Hey, you ever have one of those nights where you’re lying in bed, staring at the ceiling, and your mind starts wandering to the big “what ifs”? Like, what if something happens to me tomorrow—would my family be okay? Would they have enough to cover the house, the kids’ school, or even just the everyday stuff? I had one of those back in 2022, right after I got that first big promotion at work. I was feeling on top of the world, but then a friend’s sudden health scare hit too close to home. It made me stop and think: I had savings, sure, but was that enough? That’s when I started digging into life insurance. It felt overwhelming at first—terms like “term vs. whole,” “riders,” and all these numbers that seemed designed to confuse you. But once I broke it down, it wasn’t so bad. If you’re in that spot now, wondering how to choose the right life insurance policy in 2025, pull up a chair. This guide’s going to walk you through it like we’re just chatting over coffee—no sales pitch, no jargon overload, just straightforward advice from someone who’s been through the process and come out the other side feeling a lot more secure.

Life insurance isn’t something most of us think about until we have to, but in 2025, with everything from healthcare costs climbing to families spreading out more than ever, it’s smarter than ever to get ahead of it. Average premiums for a basic term policy are holding steady around $25-30 a month for someone in their 30s, but that’s if you shop right. The market’s evolved too—companies are using apps for instant quotes, and there are more options for things like no-exam policies or ones that build cash value like a savings account. But the wrong pick? It could leave you paying too much for coverage you don’t need, or worse, not enough when it counts. I’ve talked to friends who skipped it altogether and regretted it, and others who overbought and felt the pinch every payday. The goal here is balance: Protection for the people you care about, without stressing your budget. Let’s start at the beginning, because figuring out how to choose the right life insurance policy in 2025 all boils down to knowing what you actually need.

Figuring Out Why You Need It – The Starting Point That Changes Everything

Before you even glance at a quote, ask yourself: What’s this policy really for? Is it to cover a mortgage so your spouse doesn’t lose the house? To replace your income while your kids finish school? Or maybe just to bury the funeral costs so your family isn’t hit with a surprise $10,000 bill? I remember sitting down with a notebook after that promotion, jotting down our monthly expenses—rent was $1,500, groceries $600, daycare $800—and realizing if I wasn’t around, my partner would be scrambling. That simple exercise took 20 minutes but clarified everything. Experts call it a “needs assessment,” and it’s the foundation. In 2025, with living costs still up from a few years back—think average home prices at $400,000 and college tuition $30,000 a year per kid—you might need $500,000 to $1 million in coverage, depending on your situation.

Don’t overthink it, though. If you’re single with no dependents, a $250,000 policy might do the trick for debts and final expenses. Got a family? Aim for 10 times your annual salary as a rule of thumb. There’s even a quick online calculator on sites like NerdWallet that plugs in your numbers and spits out a recommendation. What I like about doing this step first is it cuts through the noise—insurers love to upsell, but if you know your number, you won’t get talked into something ridiculous. And here’s a little thing I learned the hard way: Factor in inflation. Money today buys less tomorrow, so add 3-4% annually to your estimate. For me, that bumped my target from $400k to $600k, and it was worth it for the extra buffer.

The Main Types of Policies – Breaking Down Term, Permanent, and the Hybrids

Once you know what you need, the next big question is what kind of policy fits. There are basically two camps: term and permanent, with some in-betweens that mix things up. Term is like renting an apartment—affordable for a set time, say 10, 20, or 30 years, and it covers you if you die during that period. It’s straightforward and cheap: For a healthy 35-year-old, $500,000 of coverage might run $25-40 a month. The catch? If you outlive the term, poof—coverage ends, no payout. But that’s often a pro if you’re buying time until the kids are grown or the mortgage is paid off. I started with a 20-year term back in 2023, and it felt right—no bells and whistles, just solid protection. Permanent, on the other hand, is like buying a house—it lasts your whole life, as long as you pay premiums, and builds cash value over time that you can borrow against or withdraw. Subtypes include whole life (fixed premiums, guaranteed growth around 3-4%) and universal (flexible payments, often tied to interest rates). These run $200-500 a month for similar coverage, but they come with perks like tax-deferred savings. Variable universal adds investment options, which can grow faster but risk dipping in bad markets. In 2025, a hot twist is indexed universal life—it links to stock indexes like the S&P 500 but caps upside (say 10%) and floors downside (0%), making it less scary for conservative folks. I looked into one after my term policy, but stuck with term for now—permanent’s great if you want legacy building, but it’s overkill if you’re just covering the basics.

Then there are hybrids, like return-of-premium term, where if you outlive it, you get all payments back—adds 20-30% to the cost but feels like a win-win. Or convertible term, which lets you switch to permanent later without a new medical exam. A friend of mine went that route when she had kids; paid a bit more upfront but avoided re-qualifying at 40 when health stuff popped up. When thinking about how to choose the right life insurance policy in 2025, match the type to your timeline: Term for temporary needs, permanent for lifelong security. Talk to a broker if it’s fuzzy—they’re free and can run scenarios.

While exploring how to choose the right life insurance policy in 2025, it’s also important to avoid common pitfalls with health coverage. Check out our guide on Top 10 Mistakes People Make When Choosing Health Insurance in the USA to stay informed and make smarter decisions.

What to Look For: Coverage Amount, Cost, and All the Fine Print

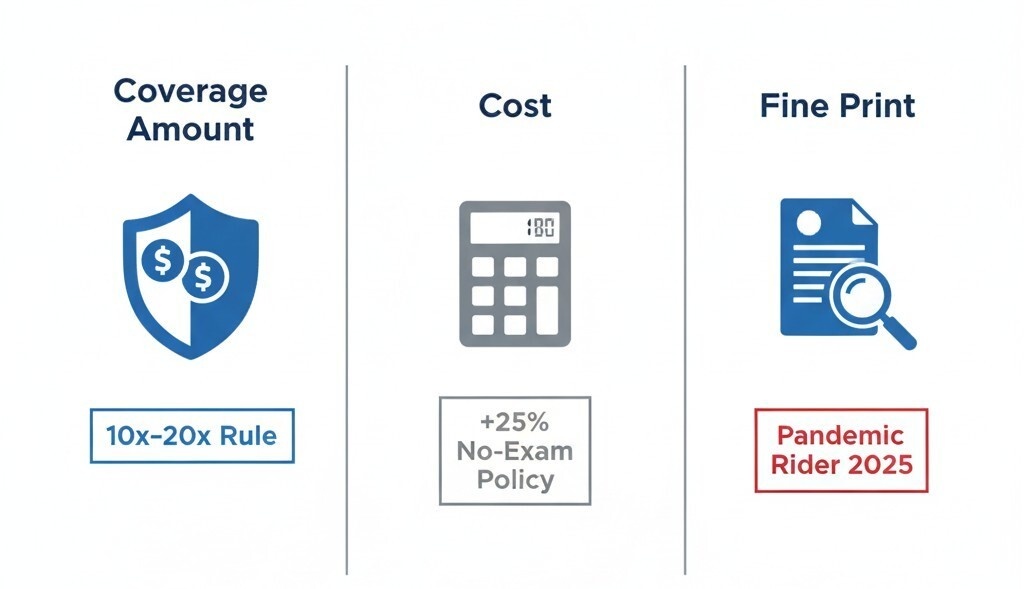

Alright, you’ve got your needs and type—now let’s zoom in on the details that make or break a policy. Coverage amount is first: Too little, and your family gets shortchanged; too much, and you’re wasting money. The old rule was 10x salary, but in 2025 with longer retirements, some advisors say 15-20x. For me, with a $60k income, that meant $600k-800k to replace earnings for 10 years plus debts. Use the rule of thumb but tweak for your life—add $100k per kid for education if college is in the picture. Cost is the next hurdle. Premiums depend on age, health, smoking status, and location— a 30-year-old non-smoker in Texas might pay $300/year for term, but add $200 if you’re in New York with higher living costs. Shop around; quotes can vary 50% between companies. In 2025, no-exam policies are booming—up 25% from last year—skipping the physical for faster approval, but they cost 15-25% more. I did one when I was busy with work; worth it for the convenience, though I paid $50 extra a month.

Don’t forget the fine print: Riders add-ons like accelerated death benefit (access 50-100% payout if terminally ill) or waiver of premium (pauses payments if disabled). Most cost $5-20/month, but they’re lifesavers. Also, check conversion rights—can you switch term to permanent later? And portability—does it travel if you change jobs? A unique 2025 thing: Some policies now include “pandemic riders” for extended illness coverage, born from COVID lessons, adding 5-10% but protecting against long-haul scenarios. When weighing how to choose the right life insurance policy in 2025, balance these—get quotes with and without riders to see the impact.

The Best Companies to Check Out for 2025 – My Picks and Why

From my shopping around, here are standout companies for how to choose the right life insurance policy in 2025. I focused on ease, rates, and customer service based on J.D. Power and A.M. Best data.

- Haven Life: Great for term. Instant online quotes, no-exam up to $1M. Average $28/month for $500k/20-year. Pros: Fast (48 hours), app-based. Unique: Their “easy app” uses phone data for health insights, speeding approvals. Cons: Term only. Ideal for young families.

- Guardian: Whole life specialist. $350/month for $500k. Pros: High dividends (average 6%), strong cash value. 2025 perk: “Family income rider” replaces lost wages stream—unique for dual-income homes. Cons: Pricier upfront. Good for legacy planners.

- Northwestern Mutual: Universal leader. $280/month. Pros: A++ rating, free financial planning sessions. Unique: Indexed options with 7-10% potential returns, floored at 0%—safe growth in volatile markets. Cons: Agent-heavy sales. Suits mid-career folks.

- State Farm: Term with flexibility. $32/month. Pros: Local agents, easy bundling with auto. 2025 twist: “Convertible plus” lets you upgrade without exam at any time. Cons: Slightly higher for smokers. Everyday choice.

- Prudential: Variable options. $320/month. Pros: Investment flexibility. Unique: “Vitality program” rewards healthy habits (gym check-ins) with premium credits up to 40%—motivational for fitness buffs. Cons: More fees. For growth-oriented buyers.

Company | Avg. Monthly ($500k Term/20yr) | Strength | 2025 Unique Feature |

Haven Life | $28 | Speed | App-based health insights |

Guardian | $350 (whole) | Dividends | Family income rider |

Northwestern | $280 | Stability | Indexed floors/caps |

State Farm | $32 | Accessibility | Anytime conversion |

Prudential | $320 | Growth | Vitality rewards |

These are solid starting points for how to choose the right life insurance policy in 2025—get quotes from three. When choosing the right life insurance policy in 2025, it’s also helpful to consider specialized coverage options. Explore our guide on Finding the Best Health Insurance Plans for International Students in the USA to ensure you get the protection that fits your needs while studying abroad.

Shopping Smart: How to Get Quotes and Compare Without Losing Your Mind

The fun part—shopping. Use aggregators like Policygenius or SelectQuote to pull multiple quotes in one go. Input age, health, coverage—takes 10 minutes. In 2025, AI makes it smarter: Haven’s tool asks a few questions and matches policies, saving time. Compare not just price, but conversion options and customer reviews on Trustpilot (aim for 4+ stars).

My routine: Quote online, then call for tweaks—mention a competitor’s rate, they often beat it by 10%. Unique hack: Time it for year-end; some companies offer holiday promotions, like 5% off for new customers in December. Don’t forget independent brokers—they’re free and access non-online carriers.

Mistakes I've Made (And How to Avoid Them)

Nobody’s perfect. I once bought term without a rider for kids—added $10k coverage later for $8/month, wish I’d done it day one. Common slip: Over-relying on employer group plans—they’re cheap but end if you quit. Another: Ignoring tobacco definitions—vaping counts as smoking for 20% higher rates. Fix: Disclose honestly, or risk claim denial. For smokers, look at “preferred” policies after quitting 12 months. And always read the suicide clause (first two years, no payout)—standard, but know it.

What's New in 2025: Trends That Could Change Your Choice

The industry’s buzzing. AI underwriting cuts exam times to days, and “behavioral” policies reward steps (like Fitbit integration for 10% off). Sustainability: Companies like Prudential offer “green” investments in variable policies, appealing if you’re eco-conscious. Longevity focus: Riders for 100+ payouts or chronic care access are standard now. Unique: “Digital twins” in apps simulate your policy’s performance over 30 years—cool for planning.