Hello there! If you’re reading this, chances are you’ve saved up some money and now you’re stuck at a crossroads. Should you put it in a Fixed Deposit (FD) because it feels safe, or should you go for Mutual Funds (MFs) because people say they give higher returns?

Your parents might swear by FDs, telling you “beta, paisa safe rehna chahiye.” Meanwhile, your friend at work is excitedly showing you how his mutual fund doubled in a few years. And you? You’re caught right in the middle — confused, worried, and maybe even a little frustrated.

You might be thinking:

- “I don’t want to lose my hard-earned money.”

- “But I also want my money to grow faster.”

- “All these financial terms are just too confusing!”

Take a deep breath. You’re not alone. Everyone who has ever saved some money has gone through this exact dilemma. The good news? You don’t need to be a finance expert to make the right choice. Think of this article as a conversation with a friend over a cup of chai. By the end, you’ll not only understand the difference but also know how to use FDs and Mutual Funds in your own life.

Let’s begin with the basics.

Table of Contents

Chapter 1: The Basics — No Finance Jargon

What is a Fixed Deposit (FD)?

Think of a Fixed Deposit like lending money to your most trusted elder. You give them ₹1,00,000 for five years. They promise to return it on time along with extra money as “interest.” No delays, no excuses.

That’s what an FD does. You give your money to a bank for a fixed period — 1, 3, or 5 years. In return, the bank pays you a fixed interest rate. At maturity, you get your original amount plus interest.

Core Idea: Certainty. You know exactly how much you’ll get, no matter what happens in the world. That’s why our parents and grandparents love FDs. They’ve never failed them.

What is a Mutual Fund (MF)?

Now imagine you and 50 friends want to buy a big fruit basket. You all pool in money and hire a professional fruit-picker (fund manager) to choose the best fruits. Some fruits may spoil, but overall the basket grows in value.

That’s a mutual fund. Thousands of investors give money to a mutual fund company. The fund manager invests it in stocks, bonds, or other assets. Instead of directly owning stocks, you own “units” of the mutual fund. The value of your units depends on how the fund’s investments perform.

Core Idea: Professional, diversified investing. You don’t bet on one company — you get exposure to many. But since values change daily, your returns can rise or fall.

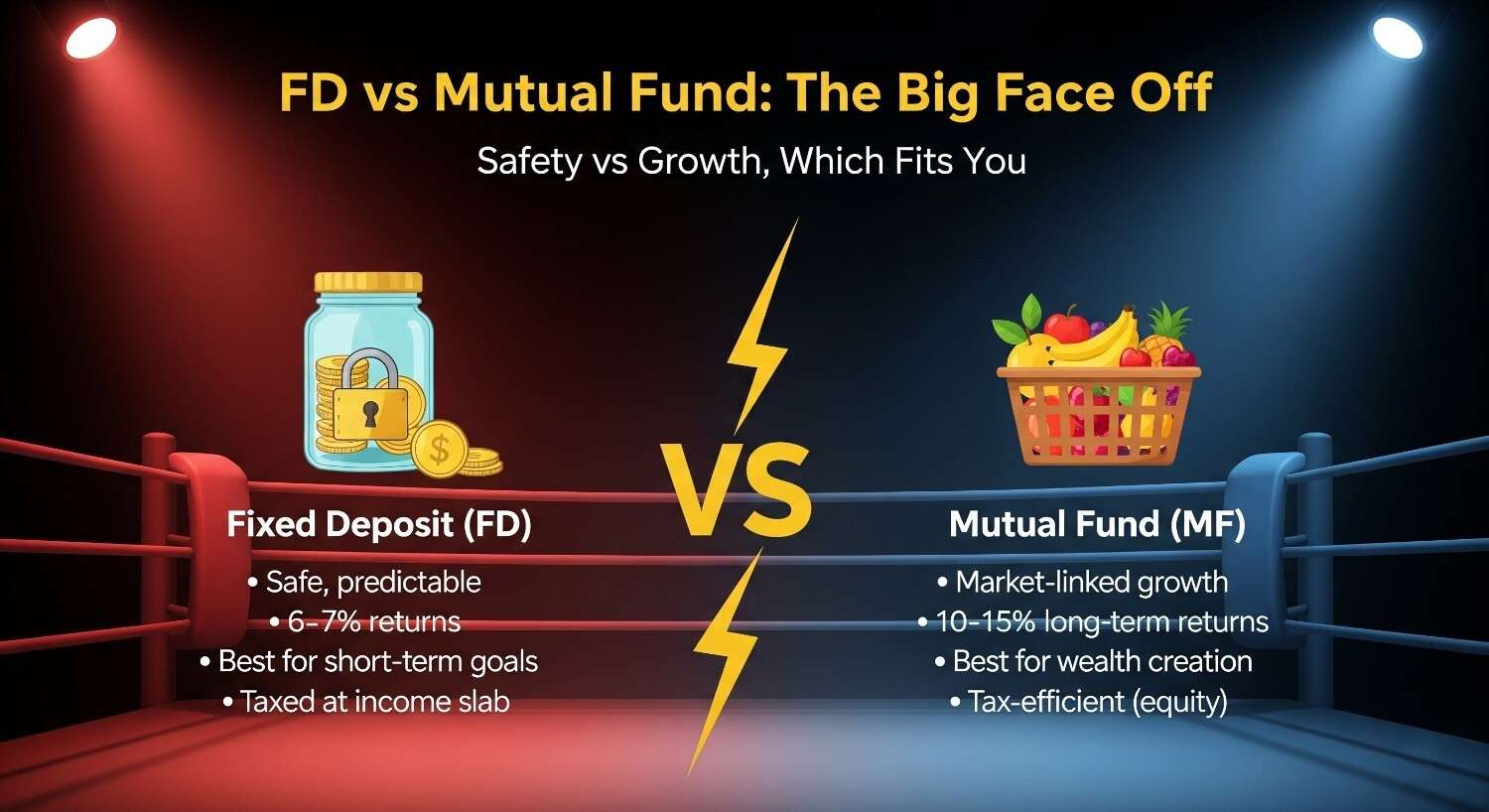

Chapter 2: The Big Face-Off — FD vs. Mutual Fund

Now let’s compare them point by point, just like a boxing match.

1. Your Goal: Why Are You Investing?

- FD: Perfect for safety-first goals. Emergency fund, upcoming vacation, down payment for a car. Basically, anywhere you can’t afford to risk the money.

- MF: Designed for long-term growth. Retirement, child’s education, house purchase in 10–15 years. If you want wealth creation, mutual funds are the way.

2. Returns: The Growth Story

- FD: Fixed, predictable returns. Currently in India, 6–7% p.a. You know exactly what you’ll get. But growth is modest.

- MF: Market-linked returns. Equity mutual funds, over 10–15 years, can give 10–15% p.a. or even more. But short-term returns can be volatile, sometimes even negative.

Example:

Invest ₹5,00,000 for 15 years.

- In FD at 7% → ~₹13.8 lakh.

- In MF at 12% → ~₹27.3 lakh.

That’s the power of compounding at higher returns. But remember, 12% is not guaranteed.

3. Risk: The Fear Factor

- FD: Almost zero risk. Deposits up to ₹5 lakh insured by DICGC. Unless inflation eats away your money’s value (hidden risk).

- MF: Depends on the type.

- Equity funds = High risk, high reward.

- Debt funds = Moderate risk.

- Liquid funds = Low risk.

Hidden FD risk? Inflation. If FD gives 7% but inflation is 6%, your real return is just 1%. After tax, maybe even negative.

4. Liquidity: How Quickly Can You Get Money?

- FD: Can break before maturity but with penalty (reduced interest).

- MF: Highly liquid. Redeem anytime (1–3 days). Exit load may apply for very short-term withdrawals.

5. Taxes: Who Takes the Bigger Bite?

- FD: Interest is taxed as per your income slab. If you’re in 30% bracket, a big chunk goes to the government.

- MF:

- Equity: Long-term gains taxed at 10% after ₹1 lakh. Short-term gains at 15%.

- Debt: Taxed like FDs (post 2023 rule change).

So equity mutual funds often win in tax efficiency.

6. Ease of Investment

- FD: Extremely simple. Walk into a bank or open through net banking. Done in minutes.

- MF: Slightly more steps — complete KYC, choose from thousands of funds, then invest via app or website. Overwhelming for beginners.

7. SIP Advantage

FDs don’t have SIPs. You need to put a lump sum.

MFs have SIP (Systematic Investment Plan) — start with ₹500/month.

Benefits:

- Rupee cost averaging (buy more when market is low, less when high).

- Affordable for beginners.

Chapter 3: The Smarter Approach — Don’t Choose, Combine Both

Here’s the truth: It’s not FD vs. MF. It’s FD + MF.

Think of FD as your spoon — steady, safe, great for soup. Think of MF as your knife — sharp, powerful, great for steak. You need both in your financial kitchen.

How to Use Both

- Define Goals:

- Short-term (0–3 years) → FD.

- Long-term (5–20 years) → Mutual Funds.

- Age Factor:

- 20s–30s → Can take risks → More mutual funds (60–80%).

- 50s+ → Safety first → More FDs and debt funds (70–80%).

- Emergency Fund:

Always keep 6 months’ expenses aside. Use FD with sweep-in facility or liquid MF. This ensures you never break long-term investments.

- Define Goals:

Conclusion: Your Money, Your Rules

Stop looking for “the winner.” FDs and Mutual Funds are not enemies. They’re teammates.

- FD = the steady beat, the safe foundation.

- Mutual Fund = the melody, the exciting growth.

Together, they create harmony in your financial life.

Your journey is unique. Take a notebook, list your goals, and match the right tool to the right goal. Don’t let fear or greed guide you. Use wisdom and balance.

Start today, one step at a time. Your future self will thank you.

Still wondering how to start your investment journey? Don’t worry, I’ve written a detailed guide that will make things even clearer for you. 👉 Read my next blog here