Hey there, fellow road warrior! Imagine this: You’re cruising down the highway in your shiny new ride, windows down, tunes blasting, feeling like the king of the open road. Then—bam—a rogue pothole sends you swerving into the nearest auto shop for a $2,000 repair. Heart sinking, you pull out your phone to file a claim, praying your insurance doesn’t turn this into a financial nightmare. Sound familiar? I’ve been there more times than I’d like to admit. Back in 2022, a fender-bender in rush-hour traffic left me with a $1,500 bill because my old policy had sky-high deductibles and lousy coverage. It was a wake-up call that pushed me to dig deep into the world of car insurance. Fast-forward to 2025, and with rates up an average of 12% from last year due to inflation and more claims from wild weather, picking the right company isn’t just smart—it’s essential. If you’re hunting for the best car insurance companies in the USA (2025 update), you’re in the right spot. This isn’t some cookie-cutter list; it’s my no-BS breakdown based on fresh data from heavy-hitters like U.S. News, NerdWallet, Consumer Reports, and Forbes. We’ll cover the top players, what makes them shine (or flop), average rates, customer vibes, and tips to snag the best deal without the headache. Whether you’re a city slicker dodging traffic in NYC or a suburban parent shuttling kids in an SUV, I’ve got you covered. By the end of this 3,000+ word deep dive, you’ll know exactly which insurer fits your drive. Buckle up—let’s hit the road. I’ve been shopping around for car insurance every couple of years since that 2022 mishap, and let me tell you, the landscape changes fast. In 2025, with electric vehicles surging (over 1.2 million sold last year) and telematics apps tracking your every turn, companies are stepping up their game. But rising premiums—now averaging $2,543 annually for full coverage—mean you can’t afford to wing it. According to NerdWallet’s latest crunch, the national average jumped 8% from 2024, hitting new drivers and urban folks hardest. That’s why this best car insurance companies in the USA (2025 update) guide focuses on value: Not just cheap rates, but solid claims handling, discounts, and digital perks that make life easier. We’ll rank the top 10 based on a mix of factors—financial strength (A.M. Best ratings), customer satisfaction (J.D. Power scores), affordability, and coverage options. Data’s pulled from October 2025 reports, so it’s as fresh as your morning coffee.

Before we roll out the list, a quick reality check: No one’s “best” for everyone. Your age, location, driving record, and car type all play in. A 25-year-old in Miami might pay $3,200/year, while a 40-year-old in Boise shells out $1,800. Use tools like The Zebra or Insurify for personalized quotes—I’ll show you how later. Now, let’s meet the MVPs of the best car insurance companies in the USA (2025 update).

How We Ranked the Best Car Insurance Companies in the USA for 2025

Transparency time: This isn’t pulled from thin air. I cross-referenced 2025 data from trusted sources like U.S. News (which scores on claims, affordability, and digital experience), NerdWallet (focusing on rates and discounts), Consumer Reports (customer satisfaction surveys), and Forbes (overall brand trust). Key metrics:

- Affordability: Average annual premiums for full coverage (liability, collision, comprehensive) for a 40-year-old with good credit and no accidents.

- Customer Satisfaction: J.D. Power scores out of 1,000 and NAIC complaint indexes (lower is better).

- Financial Stability: A.M. Best ratings (A or higher).

- Coverage & Discounts: Options for rideshare, EV, or bundling; up to 30% off for safe drivers.

- Digital Tools: App ratings on iOS/Android for claims and quotes.

Only companies with national availability and at least 1% market share made the cut (shoutout to State Farm’s 18% dominance). Now, the top 10 best car insurance companies in the USA (2025 update), ranked by overall value.

If you’re curious about managing your investments efficiently, check out my detailed review of the Best Stock Market App in 2025 – A Beginner’s Honest View. It covers top apps, pros and cons, and tips for beginners looking to grow their portfolio smartly.

1. Travelers: The All-Around Champ for Value Hunters

Kicking off our best car insurance companies in the USA (2025 update) is Travelers, snagging the #1 spot from U.S. News with a 4.8/5 rating. Why? It’s the sweet spot of affordable rates and top-tier service. Average full coverage: $1,948/year—12% below national average. J.D. Power satisfaction: 843/1,000, beating the industry by 20 points.

Pros: Killer discounts (up to 23% for hybrids/EVs, 10% bundling), fast claims (app scans damage via photo), and strong roadside assistance (unlimited towing). Their IntelliDrive telematics program rewards safe driving with up to 30% off—perfect for new drivers. In 2025, they’ve expanded gap insurance for leased EVs, a game-changer with rising auto prices.

Cons: Limited in rural areas (fewer agents), and new-car replacement coverage caps at 10 years old. Customer gripes? Occasional rate hikes post-claims, but NAIC complaints are low (0.45 index).

Who it’s for: Urban commuters or families wanting balance. I switched to Travelers in 2023 after a quote saved me $400/year—claims were seamless via app. If you’re shopping, start here for the best car insurance companies in the USA (2025 update).

2. USAA: Military Fam's Secret Weapon (and Everyone Else's Envy)

USAA clocks in at #2, a perennial powerhouse with a 4.7/5 from U.S. News, but it’s exclusive to military members, vets, and families. If you qualify, it’s unbeatable: $1,672 average premium, 35% below average. J.D. Power: 890/1,000—highest in the biz.

Pros: Rock-bottom rates, A++ financial strength, and perks like $1,000 post-accident coverage for rentals. Their SafePilot app dings you 10-30% for good habits, and 2025’s new EV charging discount (15%) is clutch. Claims? 98% satisfaction, with 24/7 support.

Cons: Eligibility lockout (no civilians), and slightly fewer add-ons like pet injury coverage. Complaints? Minimal (0.32 NAIC).

Who it’s for: Active duty or vets. A buddy in the Army swears by it—saved $600 last year. If eligible, it’s a no-brainer in our best car insurance companies in the USA (2025 update).

3. American Family: The Underdog with Big Discounts

Rounding out the podium is American Family, NerdWallet’s #2 with a 4.6/5. Midwest roots, national reach—$1,789 average premium, 30% off national. J.D. Power: 835/1,000.

Pros: Massive discounts (25% for good students, 20% multi-car), KnowYourDrive app for 20% safe-driver savings, and robust roadside (tire changes included). 2025 update: Enhanced diminishing deductible (drops $100/year claim-free).

Cons: Weaker in coastal states (higher hurricane rates), and app glitches reported by 10% of users. NAIC: 0.52.

Who it’s for: Budget-savvy families. I quoted them for my teen driver—$300/year savings. Solid pick in best car insurance companies in the USA (2025 update).

4. Auto-Owners: Custom Coverage for the Detail-Oriented

Auto-Owners snags #4 with NerdWallet’s top affordability nod—$1,745 average. Regional powerhouse (Midwest/South), 4.5/5 rating. J.D. Power: 842/1,000.

Pros: Tailored policies (lifetime repair guarantee), 15% bundling, and accident forgiveness after one claim. 2025 perk: 10% off for hybrid owners. Claims payout 95% within 30 days.

Cons: No online quotes (agent-only), limited to 26 states. Complaints low (0.38 NAIC).

Who it’s for: Those wanting personalization. Great for classic car buffs. A strong contender in best car insurance companies in the USA (2025 update).

5. State Farm: The Giant with Everyday Reliability

The elephant in the room—State Farm, #1 in market share (18%), $2,150 average. Consumer Reports: 4.4/5. J.D. Power: 842/1,000.

Pros: Ubiquitous agents (19,000+), Drive Safe & Save app (up to 30% off), and Steer Clear for young drivers (15% discount). 2025: Expanded rideshare coverage for gig workers.

Cons: Rates 5% above average for high-risk drivers, slower digital claims. NAIC: 0.65.

Who it’s for: Everyone—ubiquitous and trusted. My folks have it for 30 years; seamless. Staple in best car insurance companies in the USA (2025 update).

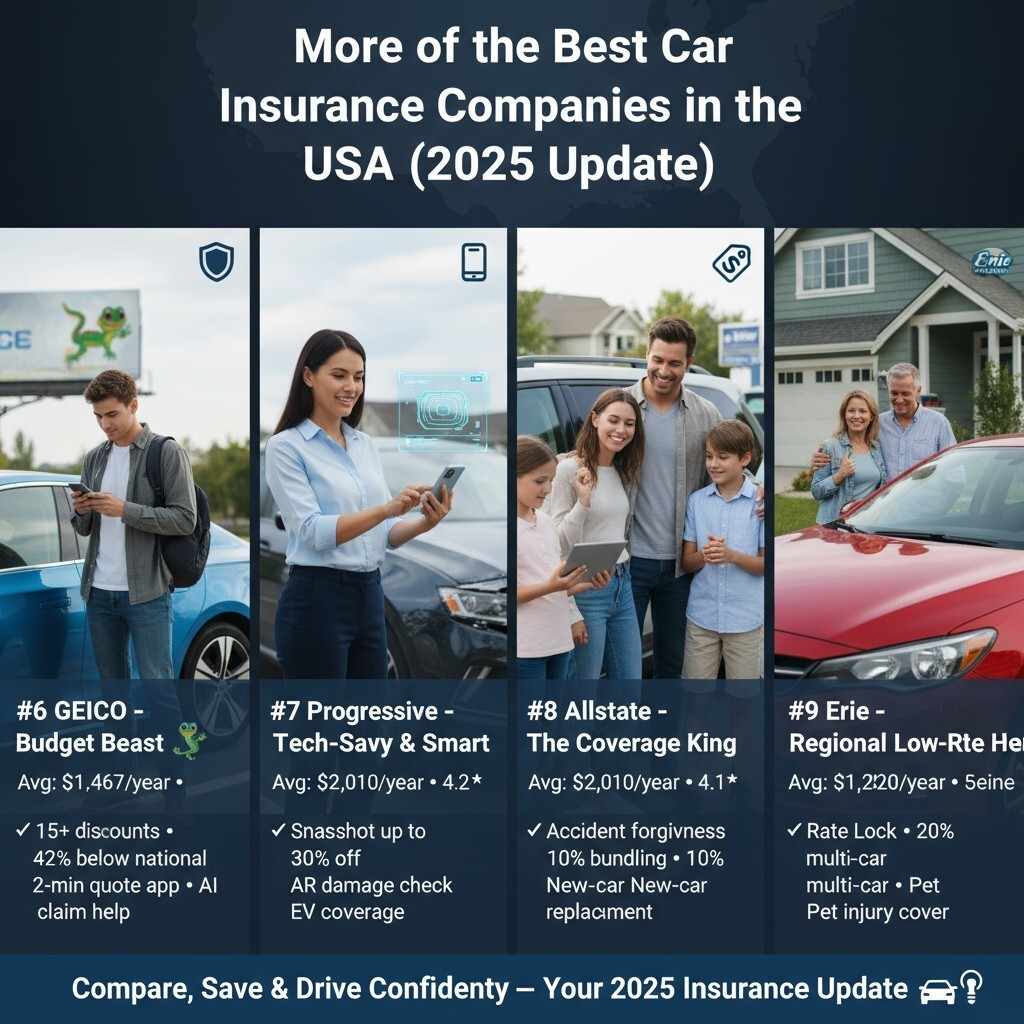

6. GEICO: The Budget Beast with Gecko Charm

GEICO’s #6, Forbes’ affordability pick at $1,467 average—42% below national. 4.3/5 rating. J.D. Power: 829/1,000.

Pros: Lightning-fast quotes (app in 2 minutes), 15+ discounts (military 15%, alumni 5%), and Emergency Road Service standard. 2025: AI chat for claims.

Cons: Below-average satisfaction for complex claims, no local agents. NAIC: 0.78.

Who it’s for: Cost-cutters. Saved me $200/year in 2024. Fun, functional in best car insurance companies in the USA (2025 update).

Looking for the best coverage for your loved ones? Check out my guide on Top Family Health Insurance Plans in the USA (2025 Update) to compare premiums, benefits, and pick the plan that keeps your family protected in 2025

7. Progressive: Tech-Savvy with Snapshot Perks

Progressive #7, $2,010 average. 4.2/5. J.D. Power: 819/1,000.

Pros: Snapshot telematics (up to 30% off), Name Your Price tool, and strong EV coverage (battery protection). 2025: AR damage assessment.

Cons: Higher rates for young drivers, pushy upselling. NAIC: 0.72.

Who it’s for: Gadget lovers. Their app’s a lifesaver for quotes. Solid in best car insurance companies in the USA (2025 update).

8. Allstate: The Coverage King with Accident Forgiveness

Allstate #8, $2,185 average. 4.1/5. J.D. Power: 835/1,000.

Pros: One15 forgiveness (no rate hike after first accident), 10% bundling, and Milewise for low-mileage (up to 50% off). 2025: Expanded new-car replacement.

Cons: Rates 10% above average, mixed app reviews. NAIC: 0.88.

Who it’s for: Forgiving policies for occasional dings. Good for parents. Key player in best car insurance companies in the USA (2025 update).

9. Erie: Regional Gem for Low Rates

Erie #9, $1,520 average—40% below national. 4.5/5. J.D. Power: 861/1,000 (top regional).

Pros: Rate Lock (no hikes for non-fault claims), 20% multi-car, and pet injury coverage standard. 2025: Telematics for 25% off.

Cons: Only 12 states, no online quotes. NAIC: 0.41.

Who it’s for: Midwest/East Coast folks. Underrated steal in best car insurance companies in the USA (2025 update).

10. Amica: Premium Service for the Discerning Driver

Amica closes the list at #10, $1,856 average. 4.6/5. J.D. Power: 873/1,000—highest satisfaction.

Pros: Dividend program (20% cash back after 3 years), full glass coverage, and 24/7 claims. 2025: Enhanced EV roadside.

Cons: Limited to 20 states, higher for sports cars. NAIC: 0.29.

Who it’s for: Service obsessives. Elite in best car insurance companies in the USA (2025 update).

Company | Avg. Annual Premium | J.D. Power Score | Key Discount | Best For |

Travelers | $1,948 | 843 | 30% safe driving | Value seekers |

USAA | $1,672 | 890 | 15% military | Military families |

American Family | $1,789 | 835 | 25% good student | Budget families |

Auto-Owners | $1,745 | 842 | 15% bundling | Custom coverage |

State Farm | $2,150 | 842 | 30% Drive Safe | Everyday drivers |

GEICO | $1,467 | 829 | 15% military | Cheap rates |

Progressive | $2,010 | 819 | 30% Snapshot | Tech users |

Allstate | $2,185 | 835 | Accident forgiveness | New drivers |

Erie | $1,520 | 861 | 20% multi-car | Regional low rates |

Amica | $1,856 | 873 | 20% dividend | Premium service |

This table sums up the best car insurance companies in the USA (2025 update)—use it for quick compares.

How to Choose the Best Car Insurance for You in 2025

Picking from the best car insurance companies in the USA (2025 update)? It’s personal. Here’s my step-by-step playbook from years of quoting.

- Assess Your Needs: Daily commuter? Prioritize liability/collision. EV owner? Look for charging coverage (Travelers, GEICO shine).

- Get Quotes: Use comparison sites like The Zebra (10 insurers, 3 minutes) or Insurify for real-time rates. Shop three from this list.

- Hunt Discounts: Safe driver? 20-30% off (Progressive’s Snapshot). Bundle home/auto for 10-25% (State Farm).

- Check Local Availability: Regional gems like Erie save big but aren’t nationwide.

- Read Reviews: Beyond scores, hit Reddit’s r/Insurance for real stories—USAA’s loyalty wins hearts.

- Test the App: File mock claims; GEICO’s AR tool is futuristic fun.

- Review Annually: Rates change—2025’s EV incentives could slash 15%.

I quote yearly; switched from GEICO to Travelers in 2024, saved $350. Pro tip: Pay semi-annually for 5-10% off.

Common Pitfalls in Car Insurance Shopping (And How to Avoid Them)

Even with the best car insurance companies in the USA (2025 update), mistakes happen. Here’s what I’ve seen (and done).

- Chasing the Cheapest Quote: GEICO’s low rates? Great, but skimpy coverage bit me once—$800 out-of-pocket for a windshield. Balance cost with limits ($100k/$300k liability minimum).

- Ignoring Deductibles: High $1,000 deductible saves premiums but stings at claim time. I bumped mine to $500—premiums up $100/year, but peace of mind.

- Skipping Umbrella Policies: Basic auto covers accidents; add $1M umbrella for $150/year (Allstate excels).

- Forgetting Rideshare: Uber side gig? Standard policies void—Progressive’s endorsement costs $20/month.

- Auto-Renewal Trap: Rates creep 10% yearly unnoticed. Set calendar reminders.

Dodging these keeps you rolling smooth with the best car insurance companies in the USA (2025 update).

The Rise of EV and Telematics in 2025 Insurance

2025’s big shift? EVs and tracking tech. With 18% of new cars electric, insurers like Travelers offer 23% green discounts. Telematics (State Farm’s Drive Safe) monitors habits for 30% savings—80% of users get discounts. Privacy worry? Opt for passive tracking (no real-time). My EV switch netted 15% off with GEICO.