Hey there, fellow wanderer! Picture this: You’re sipping coffee in a bustling café in Bali, your laptop humming away on the latest project, and the ocean breeze whispering promises of endless adventure. That’s the dream life of a digital nomad, right? But then, bam—a sudden stomach bug from that street food adventure, or worse, a twisted ankle on a hike in the mountains. Suddenly, you’re scrambling for a doctor, and the last thing you want is a medical bill that could wipe out your savings. If you’re plotting your next move between the USA and the UK, getting your health insurance sorted isn’t just smart—it’s essential. In this deep dive into health insurance tips for digital nomads: USA vs. UK, we’ll unpack everything from coverage quirks to cost traps, so you can roam worry-free.

I’ve been a digital nomad for over five years now, bouncing between continents with nothing but my backpack and a reliable Wi-Fi hotspot. And let me tell you, nothing kills the vibe faster than health scares without backup. Whether you’re a US citizen eyeing London’s foggy charm or a Brit dreaming of New York’s hustle, understanding the differences in health systems is key. We’ll cover the basics, the gotchas, and actionable advice to keep you covered. By the end, you’ll have a toolkit to pick a plan that fits your nomadic soul. Let’s jump in.

The Digital Nomad Lifestyle: Why Health Comes First

Being a digital nomad means freedom—freedom to work from anywhere, chase sunsets, and build a life untethered to one spot. But that freedom comes with risks. Jet lag, exotic cuisines, impromptu adventures… they all amp up the chance of getting sidelined by illness or injury. According to recent stats, about 30% of travelers face some health hiccup on trips longer than a month. For digital nomads, who might spend months in one country before vanishing to the next, these aren’t just vacations—they’re your life. In the USA, the healthcare system is a beast: fragmented, pricey, and tied to employment or marketplaces like the Affordable Care Act (ACA). If you’re a nomad based in the States but traveling abroad, you’re juggling domestic mandates with international needs. Over in the UK, the National Health Service (NHS) offers a safety net that’s the envy of many, but eligibility can be tricky for non-residents, pushing nomads toward private options.

That’s where health insurance tips for digital nomads: USA vs. UK become a game-changer. You need coverage that’s portable, comprehensive, and won’t break the bank when you’re earning in dollars or pounds from a beach in Thailand. Think emergency evacuations (hello, remote islands), routine check-ups (because burnout is real), and even mental health support (more on that later). Skipping this? You’re playing Russian roulette with your wallet and well-being.

As the world opens up more in 2025, with remote work booming—over 35 million digital nomads globally now—health prep is non-negotiable. I’ve seen friends grounded by unexpected bills, and trust me, it’s not worth it.

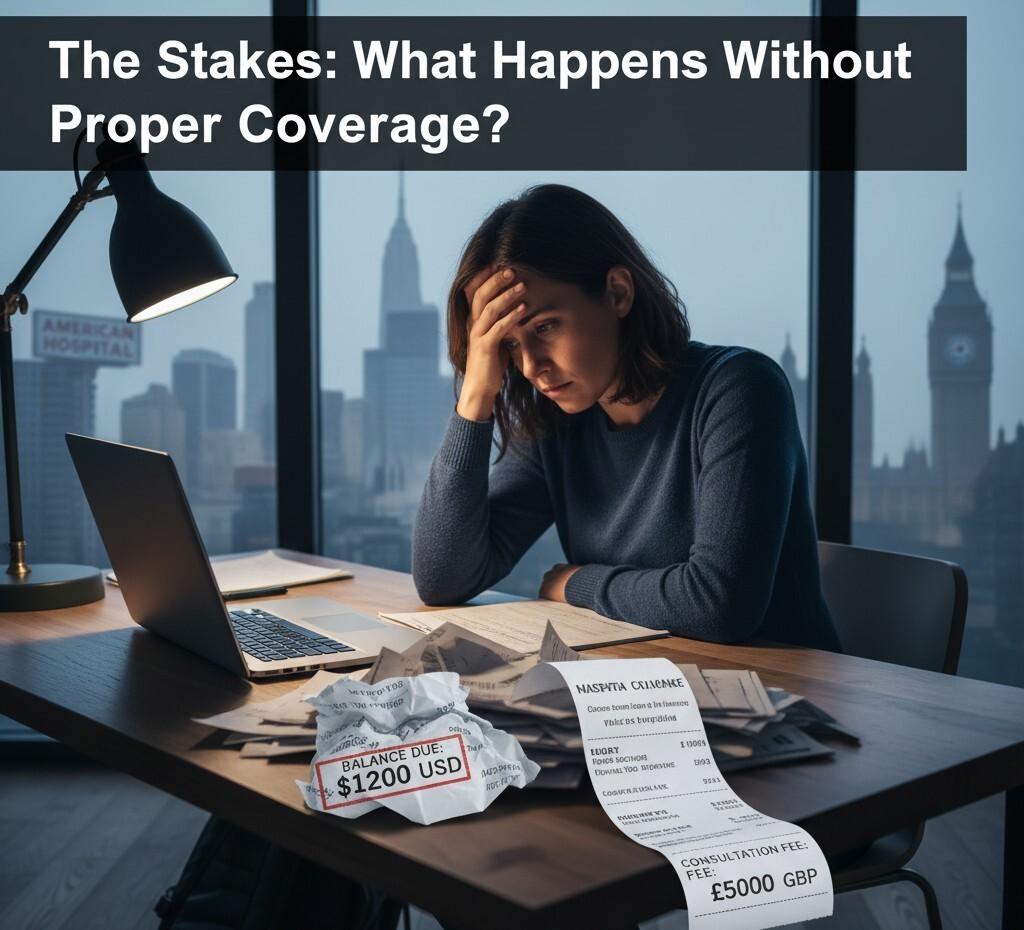

The Stakes: What Happens Without Proper Coverage?

Let me share a quick story from my early days. I was in Mexico, fresh off a US gig, when food poisoning hit hard. No insurance meant a $1,200 ER bill that I paid out-of-pocket. Lesson learned: Nomads need plans that bridge gaps between countries. In 2025, with rising medical costs—up 5-7% globally—uninsured treatment can spiral into tens of thousands. For instance, a simple appendectomy in the US could set you back $33,000 without coverage, while in the UK privately, it’s around £5,000-£10,000.

For US nomads, the ACA requires coverage or penalties, but international travel can void it. UK folks might qualify for NHS abroad via the S1 form if they’ve paid contributions, but that’s rare for full-time roamers. Without a solid plan, you’re exposed to:

- High out-of-pocket costs: A simple doctor’s visit in the US? $150+. In the UK privately? £100+.

- Evacuation nightmares: Medevac flights can hit $50,000.

- Pre-existing conditions: Many travel policies exclude them, but expat health plans often cover after a waiting period.

This is why honing in on health insurance tips for digital nomads: USA vs. UK matters—it’s about peace of mind in an unpredictable world. Don’t let a minor mishap turn into a major setback.

Demystifying US Health Insurance for Digital Nomads

Let’s start stateside. The US system is like a choose-your-own-adventure book: Exciting options, but plenty of plot twists. As a digital nomad, you’re likely self-employed, so employer-sponsored plans are out. Enter the ACA marketplace, short-term policies, and international hybrids.

ACA and Marketplace Basics

If you’re spending significant time in the US, the ACA (Obamacare) is your foundation. Open enrollment runs November to January, but special periods apply for life changes like moving abroad. Plans range from Bronze (cheap, high deductibles) to Platinum (pricey, low out-of-pocket). For a 30-year-old nomad, a Silver plan might cost $300-500/month, covering 70% of costs after a $2,000-5,000 deductible. The average individual premium in 2025 is around $7,739 annually, but subsidies can slash that if your income is under 400% of the federal poverty level.

Tip: Use Healthcare.gov to compare. But here’s the rub—ACA doesn’t cover abroad, so layer on travel insurance. If you’re gone more than 330 days a year, you might dodge the mandate, but that’s risky.

Short-Term and Travel Policies

For globetrotters, short-term plans fill gaps. Providers like UnitedHealthcare offer 3-12 month coverage starting at $100/month, but watch exclusions for pre-existing issues. For true nomads, GeoBlue Voyager shines: $50,000 emergency medical, $500,000 evacuation, and direct billing. It’s ideal if you’re dipping in and out of the US.

World Nomads is another go-to for adventure-loving nomads, covering activities like hiking or scuba, but mental health is limited—often just emergency inpatient. Costs? Around $549 for a year of basic travel coverage.

International Plans with US Inclusion

SafetyWing’s Nomad Insurance is a nomad fave—$56.28 every four weeks for ages 10-39, up to $250,000 medical, and it includes US add-ons for short stays. They even cover mental health up to $5,000 outpatient for 10 sessions yearly in some plans. Remote Health by SafetyWing goes fuller, starting at $123/month for comprehensive global care. Pro tip: If you’re under 40, bundle with an HSA for tax perks.

Challenges? High costs (average family premium $23,000/year) and network restrictions—step outside PPO networks, and bills soar. As a nomad, prioritize worldwide portability. In health insurance tips for digital nomads: USA vs. UK, the US edge is customization, but the downside is complexity. Shop during tax season for subsidies if income qualifies.

UK Health Insurance Landscape for the Wandering Worker

Across the pond, the UK’s setup feels more straightforward at first glance, thanks to the NHS. But for digital nomads, it’s not always that simple. If you’re a UK resident paying National Insurance contributions, the NHS provides free-at-point-of-use care, including GP visits, hospital stays, and emergencies. However, if you’re abroad more than six months a year, you might lose eligibility, turning you into a “temporary visitor” who pays for services.

For nomads, private health insurance is often the way to go, especially for global coverage. Plans like those from AXA Global Healthcare or William Russell offer worldwide access, starting at £100-200/month for basics. These include routine care, cancer treatment, and even mental health therapy—up to £2,000 annually in some cases.

NHS vs. Private: The Nomad Angle

The NHS is fantastic for UK-based stints— no deductibles, just show your EHIC (European Health Insurance Card) in Europe for reciprocal care. But post-Brexit, it’s limited, and for non-EU travel, you’re on your own. That’s why many UK nomads opt for hybrid plans. For example, Bupa Global provides expat-level coverage from £150/month, with options for pre-existing conditions after a 12-24 month moratorium.

Travel insurance like from InsureandGo or Post Office can supplement, but they’re short-term (up to 365 days) and exclude ongoing health needs. Costs? Basic travel medical starts at £20-50/month. For longer hauls, look to Genki or Insured Nomads, which cater to nomads with mental health counseling included—access to therapists via app, anytime.

Global Options Tailored for UK Nomads

William Russell’s international plans are popular, averaging $2,517/year for individuals in 2025, with full mental health support and no US exclusions. AXA’s Nomad Health Insurance emphasizes fast access to care, including telemedicine for those midnight worries in time zones far from home. If pre-existing conditions are a concern, check Cigna Global—they often cover after waiting periods, unlike basic travel policies that flat-out exclude. The UK advantage in health insurance tips for digital nomads: USA vs. UK? Lower base costs and a public fallback. But for true nomads, private plans ensure seamless transitions. Renew annually and declare your travels upfront to avoid claim denials.

Looking for the most reliable family health insurance options in the USA? Check out our detailed 2025 guide on Top Family Health Insurance Plans in the USA to compare providers, coverage, and costs for your family.

Head-to-Head: USA vs. UK Health Insurance for Nomads

Now, let’s compare apples to apples—or dollars to pounds. In the USA, healthcare is privatized and expensive, with average individual costs hitting $15,296/year for expats. UK private plans are cheaper, often under $3,000/year, thanks to NHS influence keeping prices competitive. But US plans like GeoBlue offer robust networks in high-cost areas, while UK ones shine in Europe.

Coverage wise: US ACA mandates essentials like mental health parity, but international add-ons are extra. UK NHS covers basics at home, but abroad, private plans like SafetyWing (popular in both) provide $250,000 medical with evacuation for $56/4 weeks. Pre-existing? US short-term often excludes; UK privates may include with waits. Mental health is emerging: US nomads via Insured Nomads get unlimited counseling; UK via William Russell, up to 10 sessions. Costs for nomads: US averages $200-500/month comprehensive; UK £100-300. In health insurance tips for digital nomads: USA vs. UK, choose based on base: US for customization, UK for affordability.

Aspect | USA | UK |

Average Monthly Cost (Basic) | $300-500 | £100-200 |

Public Option | ACA (limited abroad) | NHS (residency required) |

Pre-Existing Coverage | Often excluded in short-term; possible in expat | Moratorium common |

Mental Health | Varies; some unlimited | Up to £2,000/year |

Evacuation Limit | Up to $1M | Up to £500K |

This table highlights key diffs—use it when shopping.

Navigating Pre-Existing Conditions as a Nomad

Pre-existing conditions are a biggie. That old knee injury or asthma? Many policies look back 90-180 days and exclude. But options exist: Seven Corners expat plans cover after 12 months. For US nomads, GeoBlue might waive with proof of prior coverage. UK side, AXA offers moratoriums— no claims for two years, then covered.

Tip: Disclose everything upfront. In health insurance tips for digital nomads: USA vs. UK, get a medical check before applying to avoid surprises.

Mental Health Support: The Overlooked Essential

Nomad life can be isolating—time zones mess with sleep, constant moves strain relationships. Good news: 2025 plans are stepping up. Insured Nomads includes 24/7 counseling. SafetyWing adds outpatient limits. US ACA requires parity, so marketplace plans cover therapy like physical health. UK NHS offers talking therapies, but privately, Bupa includes CBT sessions.

Prioritize this in health insurance tips for digital nomads: USA vs. UK—burnout is real, affecting 40% of remote workers.

Top Providers for 2025: Picks for USA and UK Nomads

Based on 2025 reviews, here are standouts:

- SafetyWing: Affordable ($56/4wks), global, mental health add-ons. Great for both.

- GeoBlue: US-focused, high limits ($1M+), pre-existing options.

- Cigna Global: Comprehensive, averages $7/day, covers cancer.

- Insured Nomads: Mental health pros, $1.85/day basics.

- William Russell (UK fave): $2,517/year avg, full worldwide.

- AXA Global: Fast claims, telemedicine.

- Genki: Nomad-specific, gadget coverage too.

Compare via brokers like Nomads Insure.

Practical Tips for Choosing and Maintaining Coverage

- Assess Needs: Short trips? Travel insurance. Long-term? Expat health.

- Budget Wisely: Factor 5-10% of income for premiums.

- Read Fine Print: Exclusions for adventure sports? Add riders.

- Telemedicine FTW: Apps like Teladoc save trips to clinics.

- Visa Compliance: Some nomad visas require $100K+ medical proof.

- Renew On Time: Auto-renew where possible.

- Tax Perks: US HSAs; UK tax relief on privates.

- Multi-Country Hacks: Use EHIC for UK in EU; ACA for US returns.

In health insurance tips for digital nomads: USA vs. UK, tailor to your route—hybrid if splitting time.

Common Pitfalls and How to Avoid Them

Pitfall 1: Assuming home coverage travels. Nope—ACA stops at borders. Solution: Add global riders.

Pitfall 2: Ignoring mental health. With nomad stress high, choose inclusive plans.

Pitfall 3: Cheapskating on limits. $50K medical? Insufficient for US hospitals.

Pitfall 4: Forgetting evac. Remote spots need $500K+.

By dodging these, your health insurance tips for digital nomads: USA vs. UK game stays strong.

Wrapping Up: Roam Safe, Stay Healthy

There you have it—a full rundown on health insurance tips for digital nomads: USA vs. UK. Whether you’re team Stars and Stripes or Union Jack, the key is proactive planning. I’ve bounced from Seattle co-working spaces to London pubs without a hitch, thanks to layered coverage. Remember, the best plan is one that lets you focus on the adventure, not the what-ifs. Shop around, use tools like comparison sites, and consult brokers. Safe travels, nomad—may your Wi-Fi be strong and your health unbreakable.