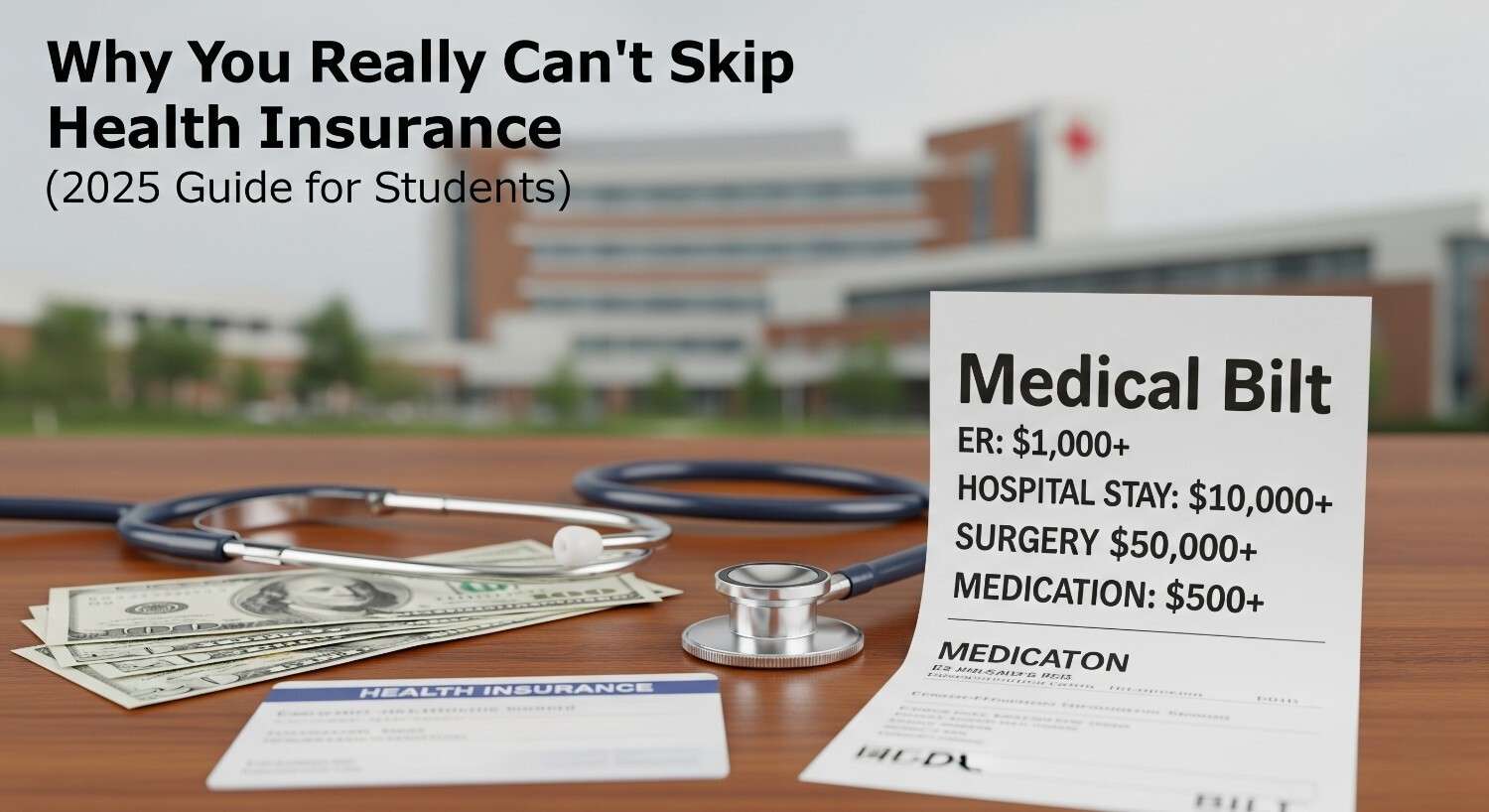

When you first start dreaming about studying in the United States, the first things that come to mind are usually fun ones: meeting new people, exploring campus, joining student clubs, maybe even trying food trucks near the university. Health insurance? Honestly, that’s probably the last thing you want to think about. But here’s the truth nobody really tells you: America might have some of the best doctors and hospitals in the world, but it also has the most expensive healthcare system. A single ER visit for something as small as a cut that needs stitches can burn through hundreds of dollars—sometimes even thousands. I’m not exaggerating. I’ve seen students arrive in the U.S. full of excitement, only to get hit with surprise medical bills. One of my friends from India skipped buying insurance for his first semester to save money. He thought, “I’m young, what’s the worst that could happen?” Well, what happened was food poisoning bad enough to land him in the emergency room. The bill was $2,400. And yes, he had to pay all of it himself. That’s why health insurance isn’t something you “maybe” need. It’s a must-have. In fact, most universities in the U.S. won’t even let you complete your enrollment without it. So, let’s talk about what your options really are and how to figure out which plan makes sense for you in 2025.

Why You Really Can’t Skip Health Insurance

Forget about the paperwork for a second. Let’s just talk about common sense. Imagine studying thousands of miles away from home, and something unexpected happens—maybe you catch a bad flu, twist your ankle in gym class, or need urgent dental care. Without insurance, you’re suddenly stuck with bills that are impossible to manage on a student budget.

Here’s how crazy expensive it gets in the U.S.:

- A quick doctor’s visit? $150–$300.

- Urgent care for something minor? $200–$500.

- Just walking into an ER? Over $1,000 before treatment even starts.

- One night in a hospital? Easily $10,000–$30,000.

Now compare that to paying $800–$1,500 for a year of health insurance through a private student plan. Suddenly, that “extra cost” doesn’t look so bad, right?

And beyond money, insurance also gives you access to preventive care like vaccines, annual check-ups, and even mental health counseling. Those things matter more than you realize when you’re far from home.

The Two Main Choices You’ll Face

Alright, let’s get practical. As an international student in the U.S., you’ll usually have two ways to get health insurance: through your university or through a private company.

The University Plan: Simple but Expensive

Most universities just enroll you automatically in their health insurance plan. You don’t need to lift a finger. The premium (that’s the cost) is added to your tuition bill, and you’re covered. Simple. But simple comes at a price. University plans are usually the most expensive option—anywhere from $1,500 to $3,500 a year. And you don’t get to customize anything. It’s a one-size-fits-all plan.

On the bright side, these plans are usually very comprehensive and always meet your school’s requirements. So if convenience is your priority, or if you have pre-existing conditions that might be tricky to cover elsewhere, this is the stress-free option.

Private Plans: More Effort, More Savings

The other route is private student health insurance. A bunch of companies specialize in these plans, and they’re often way cheaper—sometimes half the cost of university plans. You’re looking at $500–$1,500 per year instead of $3,000. You also get flexibility. You can choose a plan with a higher deductible to bring down your premium, or find one that matches your lifestyle. The catch? You’ll have to prove to your university that your private plan meets their requirements. That means applying for a waiver, filling out forms, and maybe a bit of back-and-forth with the admin office.

But if you’re willing to put in that effort, the savings can be huge.

Quick Comparison

Feature | University Plan | Private Plan |

Cost | $1,500 – $3,500/year | $500 – $1,500/year |

Enrollment | Automatic | Waiver paperwork required |

Flexibility | None | High (customizable) |

Coverage | Strong, very comprehensive | Good, depends on plan |

Best For | Students who want zero hassle | Students on a budget |

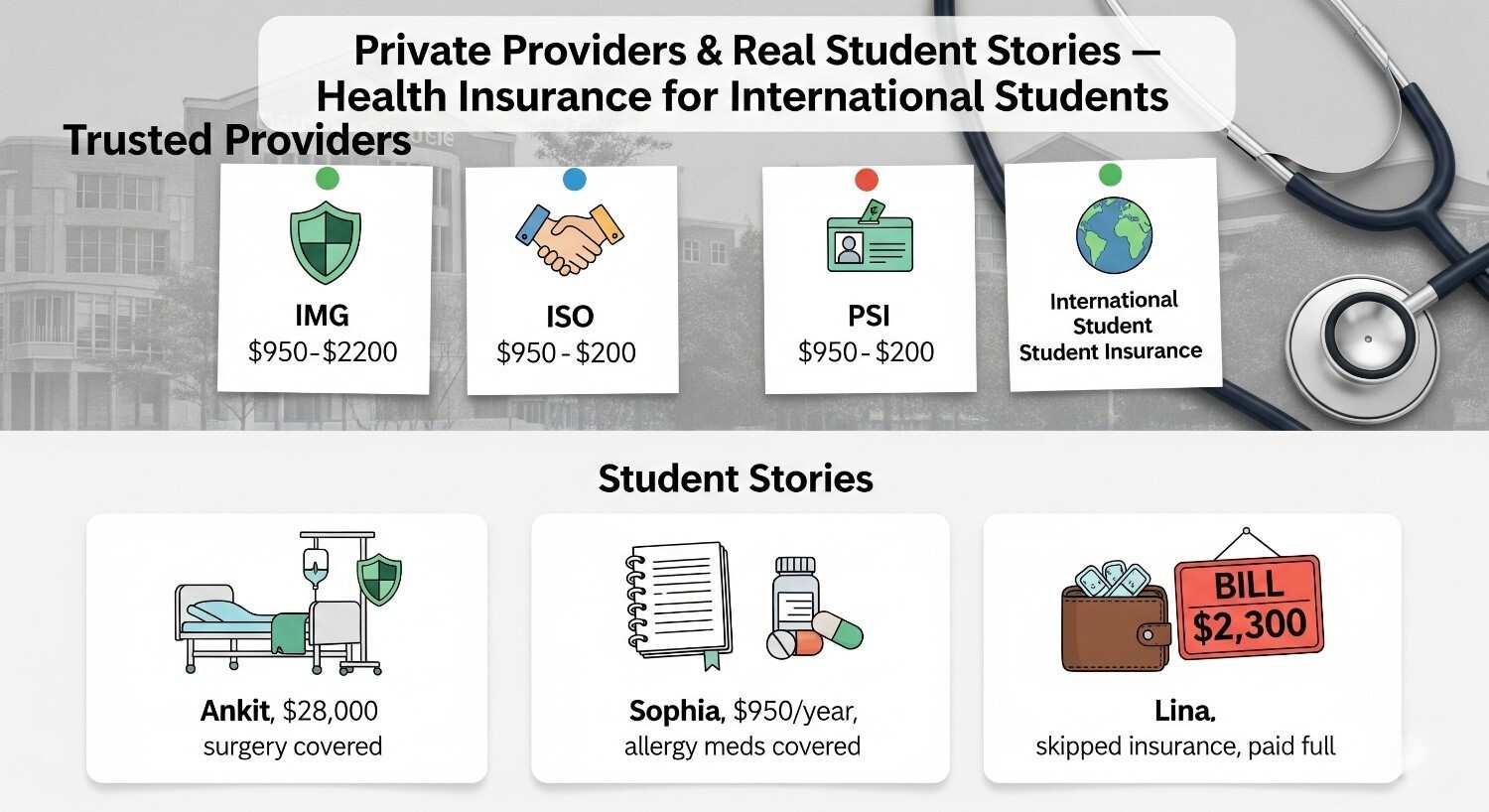

The Most Trusted Private Providers

If you’re leaning toward a private plan, here are some names you’ll keep hearing from other students:

- IMG (International Medical Group): Their Patriot America Plus plan is a big favorite.

- ISO (International Student Organization): Not an insurance company but a broker that helps you compare multiple providers like Cigna and GeoBlue.

- PSI (Per Student International): Focuses only on student plans—simple and affordable.

- International Student Insurance: Great resource for comparing options and learning the basics.

Real Student Experiences

Let me share a few quick stories that make this more real:

- Ankit from India paid $2,200 for his university plan. He thought it was expensive—until he needed surgery for appendicitis that cost $28,000. His insurance covered nearly all of it. He later said, “That $2,200 saved my life, literally.”

- Sophia from Brazil picked a private plan for $950/year. She barely needed healthcare beyond allergy medication and a couple of doctor visits. For her, the private plan made total sense, and she saved more than $1,000 compared to the university option.

- Lina from China tried to “skip” insurance in her first semester. One bad flu later, she was staring at a $2,300 bill. After that, she signed up for insurance immediately.

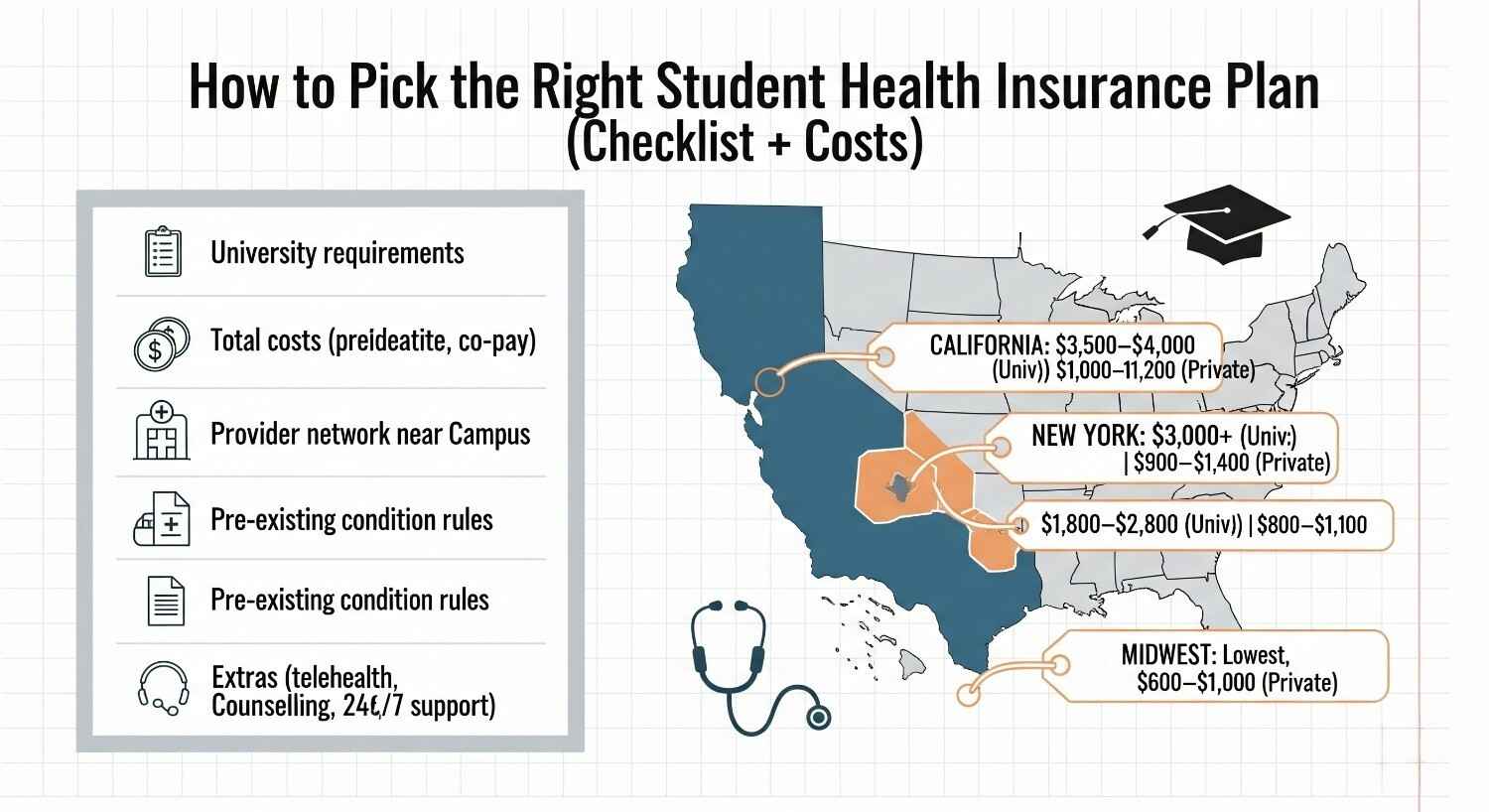

How to Pick the Right Plan (A Simple Checklist)

- Ask your university for their exact insurance requirements. Don’t skip this step—every school is different.

- Compare total costs, not just premiums. Look at deductibles, co-pays, and maximum out-of-pocket limits.

- Check the provider network. Make sure there are good hospitals and doctors near your campus.

- Look into pre-existing conditions. Some private plans make you wait 6–12 months before covering these.

- See what extras you get. Things like telehealth, mental health counseling, and 24/7 multilingual support are small but useful.

Location Matters: Costs by State

Where you’re studying can also make a difference in costs:

- California (Los Angeles, San Francisco): University plans can hit $3,500–$4,000. Private: $1,000–$1,200.

- New York: Expect higher costs, with university plans over $3,000. Private: $900–$1,400.

- Texas & Florida: Cheaper overall. University plans: $1,800–$2,800. Private: $800–$1,100.

- Midwest states: Some of the lowest costs. Private plans can be as low as $600–$1,000/year.

Final Thoughts

Health insurance isn’t the most exciting part of moving to the U.S., I get it. Nobody dreams about paperwork and deductibles when they think of studying abroad. But it’s one of the smartest things you’ll do for yourself. Think of it like a safety helmet. You hope you won’t need it, but if you do, it might be the only thing standing between you and financial disaster. Whether you go for your university’s plan (simple but pricey) or a private one (cheaper but more effort), just make sure you’re covered.

Once you’ve got that sorted, you can focus on the real reasons you’re in the U.S.—studying hard, making friends from all over the world, and creating memories that will stay with you for life.

FAQs Students Always Ask

Q: Can I just use travel insurance instead?

No. Travel insurance is for short trips and emergencies. Universities want full health insurance.

Q: What if I don’t buy insurance at all?

Your university will either block enrollment or automatically charge you for their plan.

Q: Do I need it during summer?

Yes. Most policies cover you year-round, and emergencies don’t take a vacation.

Q: Does student insurance include dental and vision?

Usually not. You’ll need to buy those separately if you want them.